All strategies and information provided are general advice only which does not take into consideration any of your personal circumstances. Please arrange an appointment to seek personal financial, legal, credit and/or taxation advice prior to acting on this information.

Introduction

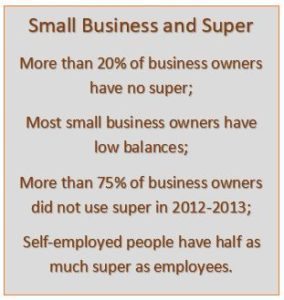

We are sorry to have to say it, but the picture for business owners and super is not a good one. In May 2016, the Association of Superannuation Funds of Australia presented a disturbing picture of the state of play for business owners and super. Here are some of the headline statistics:

- More than 20% of business owners have no super;

- 67% of business owners have less than $40,000 in super;

- Employees are 50% more likely than a self-employed person to have more than $100,000 in super;

- The average employee aged 50 or older has more than twice as much in super as the average business owner;

- In the 2012-2013 year, less than one-quarter of self-employed people made a deductible super contribution.

This last statistic really got us thinking: more than 75% of self-employed people did not put anything into super! To be honest, it left us worried. Very worried. We like business owners. We run a business ourselves. We know that business owners work harder than most people. We want to ensure that people who are working so hard in their business are getting the absolute best out of that business. At a minimum, this means that they make better use of super, so that the retirement plans of business-owning Australians do not lag behind those of their employed cousins.

Super really is super. It is a government-approved way of reducing your tax while boosting your wealth. Super lets you get the most out of your retirement. And truly enjoying your retirement goes way beyond simply having a nice lifestyle for yourself. Business owners are responsible people who are usually looking out for others. To them, a ‘good’ retirement means things like helping adult kids out financially if they need it. It also means being there and being able to help when things go wrong: when your daughter unexpectedly becomes a single mother and you want to make sure that she has everything she needs to enjoy her own young family; or when your grandchildren get sick and need expensive care and treatment.

Enjoying your retirement means being able to do what you want, when you want. And making sure that the people you love can do the same. And the simple truth is that you can only do this if you have enough money.

That is why we have prepared this ebook, setting out various practical ways to help you manage your super and your business as successfully as possible.

We emphasise the word practical. We understand that there are usually two things that stop business owners from making better use of super: not enough time and not enough cash flow. So, throughout this guide we will emphasise ways to make better use of super that take little time and make best use of cash flow.

If you can make better use of super, then you take a really big step towards ensuring that you and your family get a decent reward for the time and effort that you have put in – and the risk that you have taken on.

We would love to get your feedback on the ebook. Are there other things you would like us to examine in future ebooks? Is there something in this guide that you would like to clarify? If there is, why not get in touch with us and we can show you specific ways that you can get the most out of your small business.

Tip 1: Get the tax deduction the government wants you to have.

Superannuation is that rare beast: something that reduces your tax bill – but that the Government actually wants you to use! In May 2016, Treasurer Scott Morrison specifically stated that superannuation exists to take the burden off the Government, when he said:

The Government will enshrine in law that the objective for superannuation is to provide income in retirement to substitute or supplement the Age Pension.

The Government wants you to get the most out of super – it is their way of ensuring that you get the least out of the aged pension.

To encourage its use, the Government provides substantial tax concessions. You lay less tax if you use super properly. Let us explain.

When you or your company make a deductible super contribution (more formally known as a concessional contribution), you get to deduct the amount contributed from your income when you calculate your tax liability. So, if your business made a profit of $80,000 for the year, and you make a deductible super contribution of $10,000, you only pay tax on $70,000.

When your income is $80,000, your marginal tax rate is 30% plus a 2% Medicare levy. That means that you would pay $3,200 in tax for every $10,000 you earn. So, when you make a $10,000 contribution, and your profit falls from $80,000 to $70,000, you actually only lose $6,800 in after-tax income.

The super fund that receives the $10,000 has to pay tax. But the super fund only pays tax at a rate of 15%. So, on the contribution of $10,000, the fund pays tax of $1,500. You are left with $8,500 in your fund.

When you put these two things together, you see that, by giving up $6,800 in spending power, you acquire an asset worth $8,500. That represents an immediate, guaranteed return of 25% on your $6,800 investment.

When you put these two things together, you see that, by giving up $6,800 in spending power, you acquire an asset worth $8,500. That represents an immediate, guaranteed return of 25% on your $6,800 investment.

This is the best investment return around. And, best of all, it is guaranteed.

The Government gives you this incentive to encourage you to put money away for the future. Basically, the Government lets you keep more money if you promise not to spend it until you have retired.

Of course, they don’t just take your word for it. They get you to lock the money away in a super fund (and impose really heavy penalties if you try to get your hands on it too soon). But that is OK: the money is still their for your benefit. You just have to wait until you are older to spend it.

Once the money is in your super fund, it is invested. And the good news here is that you pay less tax on the investment earnings, as well. Usually, super is invested either in shares or in some form of cash investment,. These investments earn dividends and/or interest. You might also get a capital gain, if you sell shares for a profit.

In a super fund, dividends and interest are taxed at the same flat rate of 15%. Capital gains are taxed at just 10% of the fund provided that the fund held the asset for more than 12 months.

These tax rates are also much lower than the rates at which dividends and interest would be taxed if you held the investment in your own name. So, you lose less of your earnings to tax if the investment is held within super.

This is why super gives you what we might call a ‘double whammy.’ You start with a bigger investment ($8,500 versus $6,800 for example). Then you pay less tax on your investment earnings over time. The investment starts off much bigger – and then the after-tax returns are bigger as well.

Even better, once the super fund starts to pay you out (this usually happens when you reach retirement age – whether or not you actually retire), the fund does not pay any tax at all on teh investment earnings. That’s right: 0% tax on income and capital gains once you reach the required age.

For business owners, the asset protected nature of super is also really useful. In many cases, wealth held within super is quarantined from creditors in the event that things go wrong. This can be very reassuring for business owners.

Money held within super can also be used in ways consistent with your business. Many business owners use a self managed super fund and buy their business premises. The business then pays market rent to the super fund. The business claims a tax deduction for the rent. In the super fund, the rent is revenue. But it is only taxed at 15%. If the building is later sold, capital gains tax is usually capped at no more than 10%. Quite often, the capital gain can be completely tax-free if you sell the asset at a particular time of your life.

Believe us: super really is Super. But do not just take our word for it: here is a video put out by the Australian Tax Office, showing you exactly how you benefit from the tax benefits that apply to super.

So, you can see that super really is the business owner’s friend. That is why our first tip is simply this: super is Super and you should use it as much as possible.

Tip 2: Regular contributions – set and forget so that you don’t just forget

Super is not just a great way to pay less tax. It is also a great way to create investment assets a little at a time. For employees, this is easy. At least once a quarter, their employer sends money off to their super fund. If the employer does not, then they receive a penalty. For employees, it is all really easy.

For employers, things are not so easy.

If you own a business, there is no law saying you must get paid superannuation. Putting money into super is voluntary. And you know what happens… If you want to get a tax deduction, you have to make your contribution into super before June 30 each year. But you get to about the 15th of June each year and you think:

If I put some money into super I will be better set for retirement. I will also get a nice tax deduction. If only I had some…

That is why we always encourage people to not leave things until June. A much better way is to establish a direct debit for your super. Organise for a direct debit to go from your business account/business loan account once a month or even once a week. If you want to put $10,000 into super for the year, set the debit up for $200 a week or $833 per month. This is much easier than finding $10,000 on June 30.

Most superfunds, including a self-managed one, can accept contributions using direct debit. Many managed super funds even use BPay. You could even put the contributions on your credit card (although PLEASE make sure you pay the card off each month!)

Making small, regular contributions is not just good for cash flow. It also lets your super fund make lots of little investments over time. This is typically the best way to invest into a volatile market like the share market, which is where most super contributions end up. Investing small regular amounts is known as ‘dollar cost averaging.’ Dollar cost averaging helps ‘smooth out’ short term price fluctuations in share prices.

For example, lets say you make a single contribution of $10,000 into your super fund every June. The fund has to set $1,500 aside for tax. This means that the fund has $8,500 to invest. The fund got the money in June. SO, the fund will invest all the money in June (or maybe July if they take their time). The $8,500 gets invested all at once.

Making this large investment in June is great if the market has been falling for the past twelve months. You will be buying shares at the lowest point for the year. Buying shares when they are cheap makes obvious sense.

But making a large, one-off investment is not so good if the market has been rising for the past 12 months. You have missed the boat and you are now buying at the highest prices for the year. That makes no sense at all.

The thing is, share markets tend to rise in more years than they fall. In most years, if you invest at the end of the year, you are investing too late. You are buying after prices have risen. Bad buying.

That is why large investments at a single point in time should be avoided. It is much better to make a lot of small investments at different points in time. This smooths out the short term price fluctuations that always exist. It simply makes good sense to contribute $200 a week each week, and then have the super fund invest $170 (after paying it’s $30 tax) each week.

In some weeks, the share market will be down and your $170 will buy more shares. In other weeks, the market will be up and you will buy fewer shares. Think about that: when the market is up and prices are high, you buy fewer shares. When the market is down and prices are low, you buy more shares. You automatically buy more shares when prices are low and fewer shares when prices are high.

Imagine if you could achieve this with your business inventory. The average price of inventory has to fall. Profits would be higher. It is the same with investing. Buy more investment assets when prices are low, and your investment returns will be higher. Here is a simple video from a group called Financial Marketplace (and with a wonderful Irish accent) to explain further how dollar cost averaging works.

So remember, small regular contributions do two things. Firstly, they make sure that you actually make the contributions, which gets you your tax deduction. There is no more getting to the end of the year and having to find a large amount of money. Secondly, they let you profit from downturns in the share market by buying more assets when prices are low.

It takes about five minutes to set up a regular direct debit. If only the rest of your business life was so simple!

Click here if you would like to talk to use about how regular small contributions are the best when it comes to superannuation.

Tip 3: Out of sight, out of mind

As we said above, business owners are seriously under-superannuated. There is a single obvious reason for this: there is no law saying that business owners should be superannuated. That is not the case for your employees: the law says you have to pay their super. But not your own. Your own super is entirely up to you.

So, why don’t business owners volunteer to pay themselves super? One of the chief reasons is that the real benefits of super happen way off in the future, when you reach retirement age. A business owner in their thirties might not be able to touch their super for another thirty years. Who’s thinking of then when you are flat out getting through this year?

Super is so far into the future that it is out of sight. Out of sight and out of mind.

(By the way, this is exactly the same phenomenon that stops people giving up cigarettes. If you quit smoking, you live longer. But you get the extra years at the end of you life – way off into the future. If only we could get the extra years of life in our thirties or forties. No one would smoke then!)

This is, of course, precisely why super is compulsory for employees. The government does not even bother trying to encourage employees to save for their own retirement. Instead, it makes their employers do it for them. The Government puts super directly in the boss’s line of sight. He or she gets punished (quite heavily) if they do not make super contributions for their staff.

In sight means in mind.

So, the next tip is: why not apply this logic to your own superannuation? Give yourself a way to remember to include superannuation every time you think about your business’s profits.

Let’s say you are quoting on a job. Do you ever add 9.5% (the compulsory amount that you have to give employees as a super) to your own profit margin? Emplyees get paid $x,000 plus super. Why not think the samw way yourself when you are quoting?

Let’s say you typically use a 30% mark up on your cost of goods sold. Why not make it a 33% mark-up – and then dedicate the extra 3% to your own super? (3% of the cost of the good sold is 10% of your 30% markup – roughly 9.5% of your profit margin on the goods).

But remember, you have to take the extra step: you need to put the extra money into super, not consolidated revenue! The key is to build super into your quoting system. Add it as a line on your standard quoting tool. Set the system up so a quote can’t be completed unless you have filled out this field. Build it in so that it never becomes lout of sight.

Tip 4: Borrowing to pay super contributions can be a great retirement strategy

Have we convinced you yet? Super contributions represent the best combination of tax planning and investing. Super really is super. You should make the most of it.

But if you are self-employed, then you know one thing for sure: there is never enough cash to do everything that you want, and finding money for deductible super contributions each year is tricky.

You should think about whether you can pay your super contributions using debt. The contribution cap for the 2016/17 financial year for clients aged 50 and over is $35,000, or $2,915 per month. If you are under 50 the cap is $30,000, or $2,500 per month.

Debt can be used to pay super contributions in the same way that debt can be used to pay other business expenses. We call it ‘gearing the contributions.’ This is always something worth thinking about, but even more so if you are approaching 60. This is because there is no tax, or limit, on the amount of the lump sum benefit you can take out of (what is probably your) SMSF at age 60, or later. At this point, the money you take out can be used to retire the debt taken on to finance the contributions.

A 59 year old business owner might even borrow this year, make the contributions and achieve an immediate tax benefit, and then withdraw from the super fund next year to retire the debt.

This strategy boils down to tax deductible debt reduction, and can be a powerful strategy, particularly for those who have left super planning a little late. Which, as we say above, is most business people: almost 30% of business people have no super at all.

For example, a hairdresser using a trust to run her business can have the trustee company borrow to pay a $35,000 deductible employer contribution in the 2016/2017 year, pick up a tax break and then pay the super out, tax free, at age 60 to repay the original borrowing.

The structure of your business is important. Trusts facilitate gearing strategies especially well because, unlike companies, there is no rule against loan accounts from trustees to beneficiaries. This means a trust can borrow to pay a large deductible super contribution of, say $30,000, and then remit an equal amount, i.e. the $30,000 cash generated by the business, to the owner without triggering a tax charge. Feel free to tsalk to us if this does not make immediate sense.

Unfortunately, the strategy does not work for a business being operated via a company: the loan to the owner would be treated as an un-frankable dividend in the owner’s hands, which creates an effective total tax charge of more than 60%. So, if you operate using a company, make sure you really think through how the cash will flow.

By the way: this is another reason why it pays to get proper advice about how to structure your business.

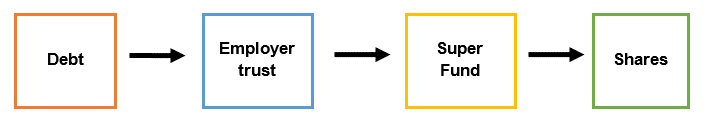

Diagram

The idea looks like this. We have assumed that the super fund has invested in shares – most do.

Borrowing to pay deductible contributions is primarily an investment strategy. Borrowing to invest is a sound idea, when done prudently. This is because economic theory and economic history show that in the long run, on average, the rate of return on each of the major asset classes is greater than the cost of borrowing. Again, we are more than happy to meet with you to talk through how this phenomenon works.

Borrowing to pay deductible contributions is primarily an investment strategy. Borrowing to invest is a sound idea, when done prudently. This is because economic theory and economic history show that in the long run, on average, the rate of return on each of the major asset classes is greater than the cost of borrowing. Again, we are more than happy to meet with you to talk through how this phenomenon works.

In this example, as with most super strategies, ultimately you have borrowed to buy shares. On its own this is usually a good move. But running it through a deductible contribution strategy means you pick up an extra super/tax driven return. This makes the investment strategy even better, and significantly reduces risk.

Consider this example: you are paying tax at a marginal tax rate of 30%. If you decide to borrow, through your business, to make a $30,000 super contribution, your tax liability falls by $9,000. This means that your total indebtedness has actually only increased by $21,000 – the extra $30,000 you’ve borrowed less the tax you will not have to pay.

In the super fund, the $30,000 is taxed at 15%. This means that the super fund is left with $25,500. So, debt grows by $21,000, but assets increase by $25,500. If anyone offered you the chance to borrow $21,000 to buy an investment asset immediately valued at $25,500, you would take it.

You have created $4,500 of wealth. What’s more, the interest on the $21,000 is deductible at 30%, where the earnings on the $25,500 are taxable at just 15%. It all makes really good sense.

The closer you are to the age of 60, the closer you are to being able to withdraw $21,000 from your super fund and being left with a $4,500 asset. The asset is even bigger if your personal tax rate is higher.

Only employer contributions can be geared

Interest incurred by an employer to pay concessional contributions for employees is deductible under the general deduction rules.

But interest incurred in connection with non-concessional contributions or personal contributions is not deductible. So, the tax deduction on the interest can only be claimed by the trustee company of your business trust, not by you as an individual. That said, if you operate in your own name, you can claim a deduction for interest on money borrowed to pay the deductible super contributions of any employees you may have. This can include family members.

Borrowing $30,000 all in one go might be confronting. You can of course consider setting up a series of twelve monthly borrowings of $2,500 each month, to be direct debited into your preferred super fund. Doing this also allows the fund to make smaller investments spread out over time, a practice known as dollar cost averaging, which is also a really good idea. we talked about this in an earlier chapter.

So, don’t leave it until it is too late: start your super and investment strategy this month, and then sit back and let time do the rest.

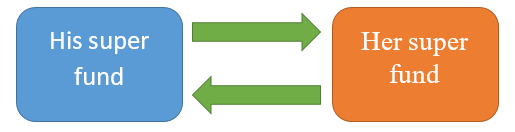

Tip 5: A tip for married couples: split super contributions between you

You may have heard the term ‘contribution splitting.’ A member is permitted to split certain contributions between themselves and their spouse by transferring the contributions they have made into their own super account to their spouse’s account. The purpose of this rule recognises that (typically) female spouses have restricted work patterns compared to male spouses. Women often take time off work to have children and raise the family, which prevents them from accumulating significant funds in their super account. This concession is designed to recognise and address this imbalance.

The rules allow for up to 85% of a concessional contribution (that is, the amount that is left after tax) made in the previous financial year to be transferred to the spouse’s account. The funds that are transferred to the spouse are treated as a ‘rollover’ and not as a contribution, and so they do not get taxed again in the hands of the recipient.

While splitting was first introduced to allow for a non or low-earning spouse to effectively be superannuated, it is often used for more pragmatic reasons. There is no rule that benefits need to flow in a particular way (for example, from the member with a higher balance to a member with a lower balance).

One common strategy is for a younger partner to split his or her contributions to an older spouse. Super is locked up until the member reaches a certain age (usually 60). Obviously, the older partner gets to this age first. So, moving benefits into this person’s account usually means that that the money will become available sooner.

One common strategy is for a younger partner to split his or her contributions to an older spouse. Super is locked up until the member reaches a certain age (usually 60). Obviously, the older partner gets to this age first. So, moving benefits into this person’s account usually means that that the money will become available sooner.

An alternative is to split contributions in such a way as to maximise future Centrelink entitlements. This might mean deliberately minimising the super balance of one or the other spouse.

We know what you may be thinking: what if we separate and I have moved all of my super into my spouse’s name? Does that mean he or she will get it all? No. Or, to be more precise, at least not because you put it in his or her name. If you do separate, and there is no agreement between you that says otherwise, it does not really matter whose name the benefits are held in. The Court will basically add up all of the assets held in each of your names and then divide the total between you according to the Court’s rules. This includes ordering that super benefits be transferred between you as per the Court’s decision. So, if the Court thinks that your partner should get all the super anyway, it does not matter whose name the benefits are held in. If he or she was going to get the super anyway, then the name on the super account won’t matter.

Tip 6: A simple way to track business expenses

All businesses want to make sure that they claim every possible deduction that they can. But costs must be substantiated to be deducted against your assessable income.

Substantiation requires you to keep records. But it’s a hassle to have to record all the little costs you incur on a day-to-day basis as you go about running your business. Indeed, things can become really silly if the time taken to record small expenses exceeds the tax benefit of doing so. There is an easier way.

One simple solution is to use two credit cards. The first credit card is used strictly for private purposes. Pay-wave lunches and coffees, clothes, groceries and other personal items. There are two associated things to remember:

- This card is only used for private and domestic costs; and

- This card is never used for deductible costs.

The second credit card is used strictly for business purposes. Petrol for your car, on-line business payments, business airfares and accommodation, automatic professional subscriptions, automated super contributions (if you operate via a trust) and so on. Once again, there are two associated things to remember:

- This card is only used for deductible costs; and

- This card is never used for private and domestic costs.

If you buy two books at a bookshop, one for personal use and one for your professional benefit, you would pay for the private one with your private credit card and the professional one with your business credit card.

Once a month, once a quarter or once a year you simply download your business credit card statement to get an automatic on-line record of your smaller deductible costs and it’s all there ready for the ATO, in the unlikely event of an audit.

You can then set your business bank or overdraft account up so it automatically pays your business credit card off using a direct debit every month. The repayment is recorded as, say, “sundry deductible costs” and is automatically coded in your accounting software.

This has two advantages. First, you will never incur any credit card interest costs. Second, you will not incur any time costs: you will never have to think about it again.

Saving time and saving money. The kind of double whammy we like.

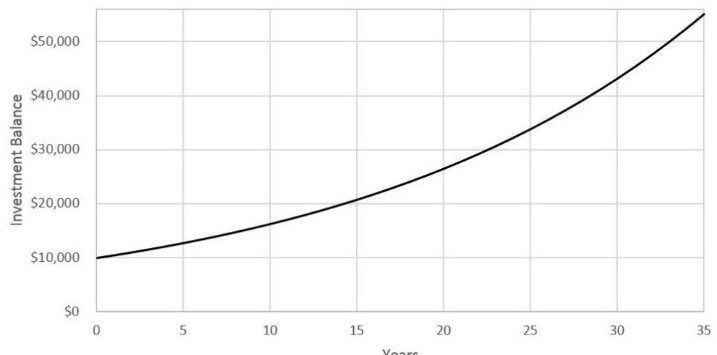

Tip 7: Start super as early as possible

Here is a tale of two business owners. Both have nothing in their super. One decides to contribute $10,000 a year into super. The other decides to contribute $30,000 a year.

Which one will retire with more money?

Actually, it is a trick question. You can’t tell just on these facts. The most important fact is how old each person is. If the business owners are the same age, then the one who contributes more will finish with more. But if the one who contributes less is younger, things get really interesting.

Let’s say that the two investors are aged 30 ($10,000 a year) and 50 ($30,000 a year). And they both make a contribution into a super fund that then uses an index-based share investing strategy. If you do not know what that is, don’t worry. For now, just understand that the return on the investment in the super fund will be the same as the market average. Over the twenty years to the end of 2015, the average return in the Australian share market was about 8.5%. Average inflation was around 3% per year, meaning that the average return after inflation was around 5.5%.

Both owners want to retire at the age of 60.

If the investment markets do the same in the future as they have in the past, the 30 year old will end up with $615,000 when he is 60. Remember, we have adjusted for inflation, so this is the equivalent of $615,000 now. The 50 year old, who is contributing $30,000 a year, ends up with just $328,000.

Both owners contribute $300,000 into super (30 years times $10,000 versus 10 years times $30,000). But one spreads this out over a longer period, and this gives his investments more time to run. He ends up with almost twice as much money on retirement.

Indeed, if the older owner wants to have $615,000 by the time he retires at the age of 60, he needs to contribute $47,000 a year into super.

The difference is all about timing. The sooner you start investing, the better.

This is a really important point for business owners. How many times have you heard a business owner say something like ‘my business is my superannuation?’ The problem is that these business owners are waiting to sell their business before they start investing for their retirement. They are leaving it way too late.

The problem is a real one. The Association of Super Funds of Australia report that almost 30% of self-employed people have no super at all. If these people are thinking about retirement at all, then they are leaving it way too late to start this form of investing. As the example above shows, late starts simply can’t be made up.

Cash flow is usually the main reason that businesses leave super until it’s too late. And we get it. Cash flow can be hard and there are always a hundred demands on your cash. But it is still imperative that you try to get even a little bit away into super each year.

Let’s say you pay marginal tax at 30%. If you give up just $70 a week after tax, then you will be able to contribute $100 per week into super. This gets taxed at just 15% – meaning that your foregone $70 has instantly turned into $85. If you then invest that $85 into an investment that gets the market average of 5.5% after inflation, then in ten years’ time you will have just under $57,000. Do it for 20 years and you will have $155,000. Do it for 30 years and you will have more than $320,000.

This is helpfully explained in the following YouTube video from the good people at Investopedia:

So think about it: for just $10 a day after-tax – the price of two coffees, you could end up with well over $300,000. You can see why you really need to start investing today, at the very latest.