All strategies and information provided are general advice only which does not take into consideration any of your personal circumstances. Please arrange an appointment to seek personal financial, legal, credit and/or taxation advice prior to acting on this information.

Introduction

It is our pleasure to offer you this Guide to Negative Gearing. The guide is one of a series of guides that we have developed. Our guides are designed to provide clearly-written, objective information about various elements of high quality financial planning.

Most people have heard of negative gearing. Negative gearing is where the income from a geared asset (that is, an asset that is bought using borrowed money) is less than the interest and other holding costs related to that asset. This creates a loss – hence the word ‘negative.’ Investors can usually offset this loss against other income for tax purposes. This creates a tax benefit, in the form of less tax being paid than otherwise, and this tax benefit in a sense adds to the investment return on the asset.

Negative gearing can make a good investment even better. But it won’t turn a bad investment into a good one. In this guide, we show you how to use the benefits of negative gearing to add real and permanent value to your investment performance.

Please feel free to pass this guide on to any other person who you think would find it beneficial. And, if you would like to discuss your own super situation, please do not hesitate to contact us.

Chapter 1: What is negative gearing?

Negative gearing occurs where the income from a geared asset is less than the interest and other holding costs, creating a loss in the short term while they hold the asset. Clients can often offset this loss against other income for tax purposes. This creates a tax benefit, in the form of less tax being paid than otherwise. In a sense, this tax benefit adds to the investment return on the asset.

Negative gearing does not make economic sense, however, unless the client also expects to earn an eventual capital gain greater than the short-term loss, so that overall the client is better off by making the investment. This capital gain is not taxed unless the asset is sold, and even then usually only half the gain is taxed, provided the asset was owned for more than 12 months.

A simple example shows how negative gearing works. Let’s assume a client buys $100,000 of property (obviously this is only for illustrative purposes!) using alternatively no gearing, 40% gearing and 80% gearing. After one year the property increases in value by $10,000. The position is as follows:

| Equity invested | Amount borrowed | Amount invested | Gain | % |

| $100,000 | Nil | $100,000 | $10,000 | 10% |

| $60,000 | $40,000 | $100,000 | $10,000 | 17% |

| $20,000 | $80,000 | $100,000 | $10,000 | 50% |

Gearing leverages the investment to increase gains when asset values rise.

But there is a ‘reverse’ gear too. Gearing leverages the investment to increase losses when asset values fall. Let’s assume our client stays in the market with her $110,000 of geared property using alternatively no gearing, 40% gearing and 80% gearing. In the second year the property falls in value by $20,000. The position is as follows:

| Equity invested | Amount borrowed | Amount invested | Gain | % |

| $110,000 | Nil | $110,000 | -$20,000 | -18% |

| $70,000 | $40,000 | $110,000 | -$20,000 | -28% |

| $30,000 | $80,000 | $110,000 | -$20,000 | -67% |

Gearing makes everything bigger and faster: the gains and the losses.

Chapter 2: Example of negative gearing – Andy

Andy is a self-employed plumber earning $100,000 a year after expenses. His marginal tax rate is 37%. Andy already owns one home, valued at $600,000. Andy has a debt of $200,000 on this home, meaning he has $400,000 in equity. Here is how his assets look:

Home: $600,000

Loan: $200,000

Equity: $400,000

Andy decides to also buy the house next door. It is also valued at $600,000. He offers his own home as security, as well as the investment property, and borrows the entire $600,000, as well as the $30,000 needed for stamp duty. After he makes the purchase, Andy’s assets look like this:

Home: $600,000

Investment property: $600,000

Total Assets: $1,200,000

Home Loan: $200,000

Investment Loan: $630,000

Total Debt: $830,000

Equity: $370,000 (total assets minus total debt)

Andy’s equity has fallen, but only by the amount of the stamp duty he had to pay.

So, the loan constitutes the ‘gearing’ part of the term ‘negative gearing.’ Now we come to the negative part.

Andy appoints a property manager and they pay all of the ongoing costs of the property, such as insurance and council rates and their own management fee. These come to $3,000 a year. He receives a rental yield of 3% on the property, or $18,000. The interest rate on his investment loan is currently 5%. On a loan of $630,000, this equates to $31,500.

This is how things look:

Income: $18,000 a year

Expenses: $31,500 interest

$3,000 other costs (rates, management and insurance)

Net income: -$16,500 a year (income minus total expenses)

These figures show that Andy makes a loss of $16,500 each year. Andy is allowed to ‘add’ this figure to his other income. But when you add a negative number, you actually subtract. So, Andy’s taxable income falls from $100,000 to $83,500. The tax payable on $100,000 of income is $24,947. The tax payable on $83,500 in income is $18,842.

This means that negative gearing has reduced Andy’s tax liability by $6,105. This means that the loss of $16,500 on holding the property is partially offset by $6,105 of less tax that is payable. Thus, the after-tax loss is reduced to $10,395.

As long as the value of the property increases by more than $10,395 per year, overall Andy will be made more wealthy because of the investment. $10,395 is 1.7% of $600,000. So, as long as the property market rises by more than 1.7%, the short term loss that Andy makes will be offset by the longer–term capital gain.

In the 10 years to December 2016, the long-term average return for residential Australian property was 8.0%. (ASX/Russell). This includes rent, which is typically about 3%, and so the rate of capital growth was around 5%. If this rate were to continue, then Andy would make a solid profit.

For the 20 years to December 2016, the overall return for residential property was 10.5% (same source), implying capital growth of around 7% per year. Again, this rate would allow Andy to make a solid profit.

Capital Gains Tax

If Andy was to sell the investment property, he would have to pay capital gains tax. If he holds the property for more than 12 months, any CGT liability is halved. This means that half of the capital gain is not taxed, and the other half is taxed at Andy’s tax rate of 37%. Overall, then, the capital gain is taxed at 18.5%.

If we ‘add this figure back’ to the required rate of capital growth on Andy’s property (1.7%), the figure rises to 2.1%. This means that, if the property rises by at least 2.1% each year (on average), then Andy will have made a gain even after he sells the property and pays capital gains tax.

That said, our advice with property is usually to keep it for the very long term – maybe even forever. And if you never sell a property, you never pay capital gains tax.

Repayment

Andy should then direct all of his repayment efforts to the home loan that existed before he bought the property. This is because the interest on that loan cannot be offset against his taxable income. This makes the interest more expensive, and Andy should aim to repay that debt as soon as possible. We discuss this further below in the section on debt management.

Chapter 3: Long-Term Growth and the Main Asset Classes

Negative gearing is not just for housing

But the term ‘negative gearing’ simply refers to any situation where the holding cost of a debt-financed investment asset exceeds the income return. Income return is the return that you receive while you continue to hold an investment: it is rent for property and dividends for shares. It is quite possible to experience negative gearing when buying shares, if the dividends are less than the interest and other costs.

As long as the dividends that are received are taxable, then the interest incurred on money borrowed to buy the shares is also deductible. This means that negative gearing still leads to a net tax deduction for the investor, regardless of whether the asset was housing or shares.

There is a third broad ‘class’ of investment asset: fixed interest or a cash-type investment such as a term deposit. The interest on this type of investment will almost always be less than the interest paid on money used to finance the deposit. However, because there is no capital growth in this kind of investment, it would be foolish to borrow money to finance this type of investment. There is no point in borrowing money at 5% and investing it at 3%. So, negative gearing does not arise when people invest in this third class of asset.

Property

Normally we don’t like to use sporting analogies to discuss investment performance. The reason is simple: investing is not a competition in which one person wins and another person loses. It is much more egalitarian than that.

Investing is more like personal fitness: the aim is to become wealthier, not the wealthiest.

But we can’t resist commenting about the ‘neck and neck’ nature of the performance of the share and property markets over the long term in Australia. The long-term performance of these asset classes is highlighted each June when the ASX/Russell Long Term Investing Report is released. You can read this year’s report here.

When the report arrives each year, we always turn first to the long-term comparison between these two major asset classes. The report compares the ten and twenty-year returns. (This is another reason we like the report – it stresses how holding investments for the long term is the best way to minimise risk). The ‘winner’ for the ten and twenty-year periods to December 2016 was property, as shown in Exhibits 1 and 4, drawn from the report (the return includes rent or dividends and capital growth).

As the extracts show, residential investment property outperformed shares over both the periods, although the relative gap between them was lower in the longer period.

Please remember that these are averages. As you may know, the property returns in markets like Perth have been lower than the national average. And within the definition of ‘residential investment property’ are some notoriously poor performing types of property, such as high-rise apartments.

Judicious selection of residential property achieved even greater returns than these averages over the period.

The real point is that shares and property achieve similar returns over the long term, and that the long-term performance, which smoothes out the ‘bumps’ of individual bad years, is typically good for both of them. It does not matter so much whether you choose to invest in shares or property for the long term – as long as you invest in at least one of them for the long term.

It is a bit like whether you go for a run or a ride on your bike. Both will make you fitter. The important thing is that you do something.

There is also a basic logic as to why the two investment classes perform so similarly. When house prices rise, people feel more confident and they spend more. This drives economic activity, which lifts business profits and causes share market returns to also rise. This increase in business wealth is then used by its recipients to purchase more housing, and on it goes.

What’s more, Australia is in the very fortunate position of being a net recipient of international migration (that is, more people come to live here than leave to live somewhere else). This increases demand for housing, which gives a strong foundation to the whole cycle.

Shares

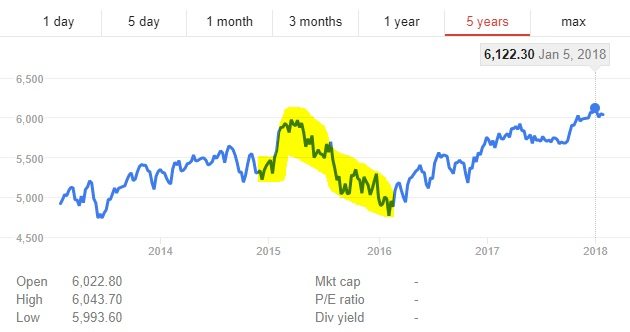

The ASX/Russell report is especially helpful when it comes to investing in shares. One of the reasons we love this report is that it underscores the importance of the long-term approach to investment. For example, if we go back a little longer and look at the 12 months between December 2014 and December 2015, the ASX 200 went from 5411 points to 5,295 points. That is a fall of just over 2%. If we add back the average yield on Australian shares for 2015 of 4%, then the overall return for the market was just under 2%. The CPI for the year was about that figure, meaning that the average investment in the share market did not gain or lose any purchasing power in that short one-year period. Shares treaded water in 2015.

Treading water is better than drowning. But you could have swum a few laps if you had simply used a term deposit at your local bank.

However, one year is way too short a period to gauge the success of an investment. If we extend the comparison beyond one year and go back ten and twenty years, a much different – and much more reassuring – story emerges.

For the ten years to December 2015, the average return on Australian shares was 5.5%. This is well above the inflation rate, and means that the average investor increased their purchasing power if they held their investment across that period. This is despite the fact that the Global Financial Crisis (GFC) occurred in 2007-2008. The GFC smashed share prices, and it occurred right at the beginning of the ten year period.

An investment returning 5.55 per year for ten years compounds to a total return of 70% for that period. If the initial investment was $100,000 in 2005, at the end of 2015 it was worth $170,000.

When we extend the analysis back over the twenty years to December 2015, the news is even better: the long-term rate of return was 8.7%. This is even further above the inflation rate and means that the investor who was in it for the truly long-term became decidedly wealthier.

An investment returning 8.7% per year for 20 years compounds to a total return of 430% across that period. If the initial investment was $100,000 in 1995, at the end of 2015 it was worth $530,000.

This is why we always stress that investments must be made for the long-term. Ten years is really a minimum time frame; the longer the better. History shows that there are few, if any, ten-year periods over which the share market turned in negative returns. Canny investors make use of that fact to substantially reduce the risk of their investment not performing.

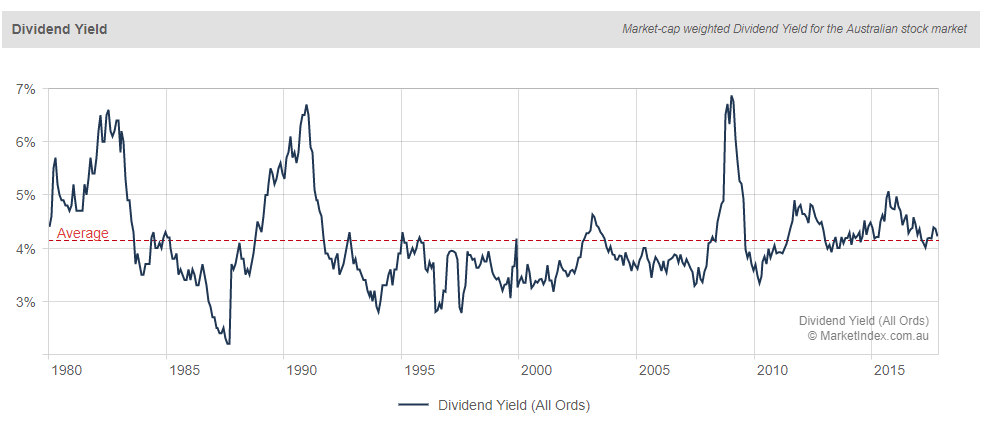

Dividend yield

The dividend yield is a way of measuring the income return of share market investments. It is calculated by dividing the dividend per share by the price per share. So, if a share costs $10 and the dividend is 50 cents per share, the dividend yield is 5% ($0.5/$10).

The long-term average dividend yield on Australian shares is around 4.3%. This is shown in the following graph, sourced from http://www.marketindex.com.au:

Chapter 4: Example of negative gearing – share portfolio

Agnetha owns a hairdressing salon which earns her about $100,000 a year after expenses. Her marginal tax rate is 37%. Agnetha owns one home, valued at $600,000. She has a debt of $200,000 on this home, meaning she has $400,000 in equity. Here is how her assets look:

Home: $600,000

Loan: $200,000

Equity: $400,000

Agnetha decides to make some share market investments. She comes to see us and we discuss the benefits of dollar cost averaging into an index fund. (We won’t go into the details of that here). Agnetha decides that she will establish a line of credit loan against her home to the value of $200,000. She will use this to make a series of monthly purchases of units in an index-tracking Exchange Traded Fund (ETF). At the end of two years, she has purchased $200,000 worth of units (including brokerage). Her net assets now look like this:

Home: $600,000

Units in ETF: $200,000

Total Assets: $800,000

Home Loan: $200,000

Investment Loan: $200,000

Total Debt: $400,000

Equity: $400,000

Her preferred ETF pays a distribution that is equal to 4% per year. This equates to $8,000 per year on the holding. The interest rate is 5% (the loan is secured against Agnetha’s home). This equates to $10,000. Agnetha therefore makes a loss of $2,000.

Agnetha’s marginal tax rate is 37%. This means that her income tax reduces by $740 due to the new loan. The effective loss is now $1,260. This is 0.63% of the amount she has borrowed – meaning that if the units rise by more than this, the capital gain will more than offset the short term loss. As with the example of Andy above, the capital gain may be taxable, but at a discounted rate. In order for Agnetha to make a profit after CGT. The capital gain needs to be 0.77% in order for there to be a gain after CGT.

The long-term performance on the Australian share market (which an index-tracking ETF will largely follow) is well in advice of this. If history even goes close to repeating itself, Agnetha will make a profit on her transaction.

Chapter 5: Debt and the prudent investor

We have never seen a self-made millionaire become wealthy without using debt. We have also never seen a self-made bankrupt go broke without using debt. Debt is a two edged sword: it can create wealth or it can destroy wealth. Most people use debt intelligently and enjoy the wealth it creates.

We have never seen a self-made millionaire become wealthy without using debt. We have also never seen a self-made bankrupt go broke without using debt. Debt is a two edged sword: it can create wealth or it can destroy wealth. Most people use debt intelligently and enjoy the wealth it creates.

Whether it is increasing equity in the family home or a rental property or a geared investment in shares, unit trusts or other securities, most prudent investors (‘PI’s’) over the last ten or so years have enjoyed an increase in their wealth. Much of this has sprung from the judicious and sensible application of debt.

The high cost of living and high tax rates make it hard to accumulate wealth from personal income alone. Superannuation, mandatory and voluntary, helps. But even double-digit contribution rates are insufficient to accumulate wealth, except over a very long time. Most people are not prepared to wait that long, i.e. until retirement, to enjoy the benefits of wealth.

Borrowing to acquire appreciating and income-producing assets is the solution.

Tax deductible debt: the prudent investor’s friend

Debt is the prudent investor’s friend. Most prudent investors who have historically borrowed money to acquire investment assets have ended up much better off as a result. This is because – again historically – each of the major asset classes has produced average annual returns significantly greater than the cost of borrowing to acquire and hold them, i.e. the interest rate. Most PIs who borrowed money over the last twenty years to buy good quality diversified assets have done well. This is even before the tax benefits are factored into the equation.

In the long term, which we define as being twenty years or more, it is very probable that the rate of return on each of the major asset classes will exceed the interest rate. And this means PI’s who have borrowed prudently to invest will become wealthier.

The basic benefit of a geared investment, that is, that the return on investment is greater than the cost of investing, is enhanced by a number of features. These include:

- most geared investments have some owner’s equity in them. Therefore, not only is the rate of return greater than the cost of funds, but that greater rate of return is earned on a larger capital base;

- most geared investments produce at least some un-realized capital gains. Un-realized gains are not taxed until they are realized. And when they are finally realized are only 50% taxed provided they are held for more than one year. Warren Buffett calls this tax deferral an ‘interest free government loan;’

- tax benefits will exist if the assessable income (which does not include un-realized capital gains or half of any realized capital gains on assets held for more than a year) is less than the allowable deductions, i.e. if the investment is negatively geared; and

- sometimes, tax benefits can be enhanced by the intelligent use of depreciation, repairs and pre-paid interest arrangements.

Investing in a diverse range of assets is a good idea when gearing. Diversification reduces risk. Do not have all your eggs in one basket. By investing in a number of different assets and a number of different asset classes one can reduce the risk of specific asset values falling, and, in particular, reduce the risk of them falling below the debt, so that owner’s equity is wiped out. How much, or how little, diversification there is depends on the investor’s own expectations of performance and attitude to risk.

Despite the need for these cautions and comments, it is clear that those who borrowed money to gear sound investments over the last ten years or more have by now mostly done very well. Many wish they had geared more investments. Those who lost money on geared investments tended either to sell too quickly or they speculated on unrepresentative shares. They did not fully appreciate that property and shares investments are long term, (i.e. at least ten years,) and a year or two of poor performance does not mean that they should be sold. Others just made poor investment decisions. Thankfully, these tend to be the minority, and it is rare for all investments to perform poorly. Normally it is just one or two. Diversification is the key here, reducing the prospects of being left with just one or two poor performing assets.

Despite the need for these cautions and comments, it is clear that those who borrowed money to gear sound investments over the last ten years or more have by now mostly done very well. Many wish they had geared more investments. Those who lost money on geared investments tended either to sell too quickly or they speculated on unrepresentative shares. They did not fully appreciate that property and shares investments are long term, (i.e. at least ten years,) and a year or two of poor performance does not mean that they should be sold. Others just made poor investment decisions. Thankfully, these tend to be the minority, and it is rare for all investments to perform poorly. Normally it is just one or two. Diversification is the key here, reducing the prospects of being left with just one or two poor performing assets.

It is hard for anyone, PI’s included, to accumulate significant wealth without taking on at least some debt for some time. The amount of debt is a matter of choice, and reflects an underlying attitude towards risk. But as a general proposition, over the last ten years, PIs who borrowed to acquire sound investments did a lot better than those who did not

Looking to the future, then, it is likely, therefore, that PIs who take on debt to acquire more investments will accumulate more wealth than those who do not. Sadly there are no guarantees that this will be the case, and each person has to make their own decisions. What is good for one person may not be good for another. But as a general proposition, investors who borrow to invest prudently will probably do quite well.

Borrowing to Invest

If you need more encouragement, or perhaps convincing, that IPs should be borrowing more, shout yourself a copy of Noel Whittaker and Paul Resnik’s book “Borrowing to invest: the fast way to wealth: a user’s guide for borrowers”. No one could ever accuse either of the two authors of lacking conservatism, and they each have ‘elder statesman’ standing in the financial advising community.

Published by Simon and Schuster in July 2002, paragraph 1 of chapter 1 reads:

“Are you prepared to use other people’s money to build a better life for yourself? Have you stopped to think about what will happen if you don’t? Chances are you would never own your own home. Every mortgage is, after all, built on someone else’s money. And, unless you are heir to a fortune, it’s just as likely that your years in retirement will be years of watching the dollars.”

This paragraph, and the title of the book “Borrowing to invest: the fast way to wealth”, gives you a good idea of their basic thesis. But we recommend you read the rest of the book to find out what else they have to say.

In her excellent book “Personal Finance for Australians for Dummies” Barbara Drury writes:

“Many people still feel uncomfortable about borrowing money to invest, a practice referred to as gearing. Yet the same people cheerfully borrow to the gills to buy their own home because they understand that the only way to own such an expensive asset is to use other people’s money.

Borrowing to buy growth assets, such as shares or property, and using your own cash or equity in your home as a down payment, helps you increase your returns. You make a profit as long as the investment returns (income plus capital gains) are greater than your interest payments. Say you have $10,000 and borrow another $10,000 at 8% interest to buy shares with a dividend yield of 4%. The dividends of $400 cover your interest payments but you stand to make double the profit when you sell the shares because you bought twice as many shares as you could have done with your own money.

Gearing can substantially increase long-term investment returns, but it magnifies the potential risks as well as the potential rewards. If you choose to gear into shares or investment property, invest in a diversified portfolio of high quality assets that have the best chance of producing solid capital growth over the long term. Never gear to invest in speculative investments, or to avoid tax.”

An investment is “negatively geared” if its income is less than the interest incurred on any amounts borrowed to acquire it. An investment is neutrally geared if the income derived from it is (roughly) equal to the interest incurred on any amounts borrowed to acquire it. And, similarly, an investment is positively geared if the income derived from it is greater than the interest incurred on any amounts borrowed to acquire it.

The investment may be property, whether residential, retail, commercial or industrial, shares or similar securities in listed or unlisted companies, or managed funds or indexed funds. Each of the major asset classes is suited to geared investment strategies.

The word “geared” is chosen because of its engineering connotations: the idea is that with correct gearing or leverage a result can be obtained that is better than that obtained without gearing. This is usually achieved by expanding the practitioner’s asset base and allowing time to run, and capital gains to accrue, which more than compensate for the deficiency in cash flow caused by the interest being greater than the income.

This technique usually works. But there is no guarantee that it will. It depends on the quality of the underlying investment. A word of caution is appropriate: gearing works in reverse to. The effect of any drop in value will be greater too, and it is possible that the practitioner’s equity in an investment can be wiped out as a result of this phenomena.

A rational investor will be prepared to negatively gear an investment if the expected after tax return, including capital gains, is greater than the expected after tax cost of holding the investment. The after tax return will usually be made up of two things; one, the income from the investment (i.e. rents, dividends, or distributions, depending on the investment), and two, the increase in value, or capital gain, over time. The income can usually be predicted with reasonable certainty. The capital gain is the wild card. No one knows the future, so the best one can do is expect a capital gain. This is where investing becomes an art rather than a science; expectations will be the critical issue.

We have never seen a wealthy person who at some stage has not taken on at least some debt for business or investment purposes. We have also never seen a bankrupt person who has not taken on at least some debt as well. It is clear that debt is a two-edged sword: it can increase investment returns and it can reduce investment returns.

It is best to keep to sensible debt levels, manage interest costs and to favour higher income yielding investments if the downside of debt is to be avoided.

The Australian Master Financial Planning Guide says that:

“An investor should only make a negatively geared investment if:

- the investor has secure and permanent income from other sources sufficient to cover living expenses and all other requirements as well as the shortfall under the negative gearing;

- where the gearing arrangement or borrowing includes a liability to make margin calls in certain circumstances, the investor can satisfy the margin calls by supplying further security or by payment from other sources to avoid the possibility of a forced sale (keep in mind that the economic conditions that lead to the need for a margin call will, almost certainly, mean that any forced sale will be at depressed prices and will lead to a significant loss to the investor;

- the investment is made on the understanding that it will be retained for at least five, preferably, ten years or longer;

- the investment and borrowing have sufficient flexibility to cover events such as death, disablement; major illness or redundancy. The first three of these would normally be covered by insurance or superannuation benefits and redundancy could be covered by an employer pay out. However, even in these circumstances the negative gearing arrangement … may need to be terminated. Check whether this can be done without incurring penalties and with the flexibility to avoid suffering loss through a forced sale of the asset;

- there is flexibility to cover changes in circumstances, such as a transfer overseas (where the tax advantages may not apply) or divorce; and

- the taxpayer can take full advantage of the tax deduction. Negative gearing normally works best for investors on the highest marginal tax rate but may be of less value to low tax rate or non-tax-paying investors.”

The author then warns of the danger of negatively gearing into an already geared investment, such as a listed company or a property trust. This increases both the up-side risk and the downside risk even further.

Handy hints for getting the money

If you are a prudent investor with a good credit rating, and you are buying an asset that would be regarded as representative (for example, an investment property in a well-regarded suburb), then you should be able to obtain loan finance reasonably easily. That said, there are some things you can do to make it more likely that someone will lend you money for your investment.

Research costs before you sign the contract. Make sure you know the interest rate, the principal repayment rate, the administration costs and the early repayment penalties.

Shop around. The first offer is unlikely to be the best offer. Some finance brokers specialize in investors. We generally find them quite good. Their rates are as competitive as the banks will give directly and their service is usually exemplary: perhaps they are more aware of their exposure to bad word of mouth advertising – especially in the age of Facebook and Twitter!

Shop around. The first offer is unlikely to be the best offer. Some finance brokers specialize in investors. We generally find them quite good. Their rates are as competitive as the banks will give directly and their service is usually exemplary: perhaps they are more aware of their exposure to bad word of mouth advertising – especially in the age of Facebook and Twitter!

Make sure that your finance application is clear and to the point. Support it with recent accounts, company searches, business plans and similar documents where necessary. These materials are best included as appendices to the main application as they may cloud the message you are trying to deliver. If the loan is for business or investment purposes, stress this, as it may be relevant if the ATO questions the deductibility of any interest claimed on the loans down the track.

Ensure that your application shows all repayments can be met out of existing and expected business cash flows. If asset sales are contemplated in the short or medium term then say so, as this is very relevant to your capacity to service the debt. Financiers may not be impressed if the repayment of principal depends solely on the sale of the object investment.

Do not borrow too much. Most banks work on a debt to equity ratio of about 70:30. But in working out the value of your equity, they discount historical cost by factors representing their expected resale experiences. Take account of these discount factors before you commit yourself to a transaction. Ensure that your finance application includes all relevant materials. This should include all financial information that does not favour your application. If something goes wrong later on and the bank finds out that you withheld certain information then, to say the least, tempers could rise.

Keep the communication channels clear. If something does go wrong, tell the bank straight away. This is important because banks base their recovery actions on how they perceive the borrower to have behaved. Trust is very important with banks. If your word is your bond then you will get much better treatment if an unexpected situation arises. For example, time and time again we have seen banks extend an existing facility over the ‘phone without any extra security when a PI has asked for it, whether it be to use as a deposit for a new property or whatever. Because trust has been established the banks will come to the party and help you out where needed. Open and honest communication is the key to building this sort of a relationship, and once it is created, don’t waste it!

The banks will be extremely reasonable if you are reasonable with them. It is therefore important to play with a straight bat at all times.

Chapter 6: Don’t mix your debts

Often, an investor who is making use of negative gearing will also have borrowed money for some private purpose, such as buying the house they live in, or a personal loan, or a private credit card.

It is very important that the debts are kept separate in this situation. Separate loan accounts, perhaps even with separate lenders or with the loans held in different names, are very useful.

The reason for this is that the tax-deductible nature of interest on investment debt (‘investment interest’) makes it cheaper than non-deductible interest that is being charged at the same interest rate. So, an investor paying 5% on both a private home loan (non-deductible interest) and an investment property loan (deductible interest) is actually paying something less than 5% on the investment loan. If the investor’s marginal tax rate is 30%, for example, then the effective interest rate is 30% less than 5%, or 3.5%.

Where these two types of debt co-exist, then, it makes sense for all repayment efforts to be dedicated to repaying the more expensive loan first. This will typically be the private debt.

At the same time, it makes sense to use borrowed money to pay any expense for which interest on borrowed money would be deductible. By borrowing the money for these expenses, you free up as much of your cash flow as possible to be used to pay down the non-deductible debt.

AMP refer to this as ‘debt recycling’ and you can read their thoughts on it here. As it happens, ‘debt recycling’ is a misnomer. The debt is not recycled. One debt is removed and another is created. They are two different debts. The second debt is entirely new. But let’s not quibble – the AMP is better at developing strategies than it is at naming them.

If the loans are not separate, then it becomes much harder to target the non-deductible debt for prioritised repayment. To use a simple example: suppose you use a single debt facility to pay for a $100,000 extension on your home (non-deductible debt) and you also borrow $100,000 to buy shares, using the same debt. You have single debt worth $200,000. Half of the debt is private and half is investment. This means that half of every repayment is used to reduce the investment debt – and half is used to reduce the private debt. If you pay off $20,000, for example, then you are effectively left with $90,000 each of private and investment debt.

Now suppose you used two entirely separate loans for these expenses. You will have two loans, each worth $100,000. You can repay the entire $20,000 into the private loan, leaving you with a balance of $80,000 in that loan. The other loan, for which the interest is deductible, remains at $100,000. The interest on this second debt will be higher, meaning that you will have maximised the amount of tax-deductible interest by keeping the loans separated.

The separation needs to be real, though. Essentially, you need to be able to produce the bank statement for the investment loan and show that every dollar drawn on that loan was used to buy investment assets. And the money needs to flow directly from the loan to the purchase of the asset. You can’t draw the money from a new loan and use it to repay an old loan – this is a private, non-deductible purpose.

You can read some more about the ATO’s thoughts on the deductibility of interest here.

The other thing to keep in mind is that there is no way to be tricky when it comes to tax. The tax office has seen it all, and they will understand what you are doing even better than you do. So, try to be tricky and you can expect things to go badly. But there is no need to worry if you do things right. Negative gearing is approved government policy. Here is what Prime Minister Malcolm Turnbull said about it in on his own personal website in April 2016:

“The ability to deduct interest and other costs from personal exertion income has been a generally accepted principle in Australia’s tax system for more than a hundred years.”

Chapter 7: It’s not about the tax

When should negative gearing be used to reduce a tax bill?

The answer is never. Clients should only borrow money to buy an asset if the expected income plus the increase in the asset’s value exceeds the interest and other costs connected to owning the asset. In other words, the expected total return must exceed the expected total cost of the investment.

The answer is never. Clients should only borrow money to buy an asset if the expected income plus the increase in the asset’s value exceeds the interest and other costs connected to owning the asset. In other words, the expected total return must exceed the expected total cost of the investment.

This means that the expected before-tax gross income plus the expected before-tax capital gain must be greater than the prevailing interest rate before a rational investor would borrow to buy an income-producing investment. If the level of income plus capital growth is below this you will lose money.

How high you go above the prevailing interest rate depends on your perception of the risk implicit in the investment. As a guide, we often suggest that the rate of income plus capital return should be about 4% higher than the prevailing interest rate.

Without such a margin it’s just not worth the effort. If this base condition is not met, it doesn’t matter that the net loss on owning or holding the investment is tax-deductible. A loss is a loss. You would actually be better off paying income tax and putting what’s left of your money in the bank.

It’s critical to see negative gearing as an investment strategy with a tax benefit, rather than a tax strategy with an investment flavour. Clients should never negatively gear an investment just to get a tax benefit. Negative gearing only makes sense where the client genuinely and reasonably expects the after tax capital gain on ultimate sale, plus a premium for risk, to be significantly greater than accumulated tax losses on holding the asset, adjusted for the time value of money.

Chapter 8: Positive gearing

Positive gearing is where the income from a debt-financed asset exceeds the interest cost. This is actually quite rare in property investment, but no so rare in share investing.

For example, in December 2012 ASX Investor Update newsletter Paul Zwi from Clime Investment Management observed that National Australia Bank shares offered a high dividend rate of 7.5% or 10.7% grossed up for franking credits.

For example, in December 2012 ASX Investor Update newsletter Paul Zwi from Clime Investment Management observed that National Australia Bank shares offered a high dividend rate of 7.5% or 10.7% grossed up for franking credits.

Clients who borrowed to buy NAB shares would have experienced positive gearing: the dividend return was greater than the interest cost. The shares would have paid for themselves, and a bit more, even before capital gains were considered.

Positive gearing may reduce risk. By improving cash flow, it improves the client’s ability to reduce debt or make fresh investments – or both. Common sense is needed: the critical question is ‘will the expected income in fact occur?’ Advisers should always complete their due diligence – but to be frank if you stick with blue chip investments like NAB shares it’s hard to see what can go wrong.

We have seen structured positive gearing products blow up in client’s faces. In 2007 one well-known institution marketed a positive gearing arrangement where clients borrowed from one arm of the institution at 9% per annum, to invest in another arm of the institution at a “guaranteed” 12% per annum. What could go wrong? Well, what went wrong was there in the fine print all along. The ‘guarantee’ was not a very good guarantee and was in fact discretionary. Not surprisingly, after about 6 months the institution invoked its discretion and stopped the 12% income payments to clients, but continued to enforce the 9% interest charge on clients.

From the institution’s point of view the fine print was very fine: there was nothing the clients could do but pay up and wait for five years to get their money back, less interest. The institution made a fortune from it.

So, while the logic of positive cash flow investments is strong, caution needs to be applied. Positive cash flow might also mean that relatively few people want to own the asset – which may make future capital returns problematic.