All strategies and information provided are general advice only which does not take into consideration any of your personal circumstances. Please arrange an appointment to seek personal financial, legal, credit and/or taxation advice prior to acting on this information.

Last updated: July 2024

Introduction

Superannuation, or ‘super’ as it is more often known, is a cornerstone of most people’s personal financial management. Apart from their own home, for many people superannuation comprises their entire personal wealth. It is very important.

Super is a long term savings arrangement designed to assist individuals to accumulate wealth to enable them to fund (at least some of) their own retirement. Becoming self-sufficient reduces people’s reliance on government services such as the age pension.

Many countries use some form of superannuation. Australia’s current system of superannuation took form in 1983, when the then Hawke Labor government reached an ‘Accord’ with trade unions such that the unions agreed to forego direct pay increases in return for the introduction of compulsory super contributions for their members. Initially, employers were obliged to contribute an amount equal to 3% of their employees’ salary or wages into a super fund on that employees’ behalf. At a stroke, all affected workers started to save 3% of their annual income in a savings vehicle which could not be accessed until retirement. Compulsory saving for the future.

The system was expanded in 1992 to cover all Australian employees. This system became known as the ‘Superannuation Guarantee’ and it is still in place today. The introduction of compulsory super came as demographic analysts realised that the Australian population was ageing and this would place a substantial strain on social security benefits paid by the Government (especially the old age pension).

Originally, most superannuation funds were managed by professional money managers. Over time, a system through which people can manage their own superannuation has been developed. People manage their own superannuation through what is known as a self managed superannuation fund, or SMSF. As at 30 June 2022, there were more than 603,000 self-managed superannuation funds with more than 1.12 million members. Together, these funds manage approximately 26% of all superannuation assets in Australia. (Source: ATO)

This guide is all about SMSFs. We explain what an SMSF is, who an SMSF suits, how to use an SMSF and how to ‘finish up’ an SMSF when it is no longer needed.

This guide is a starting point for self managed superannuation. If you have an SMSF, or if you are thinking of establishing one, we encourage you to get in touch with us. Running your own SMSF can be both personally and financially rewarding – but it needs to be done right and we can help you ensure that you make an intelligent and informed decision about whether and how to manage your own superannuation.

We hope you enjoy this guide!

Chapter 1: What is a SMSF?

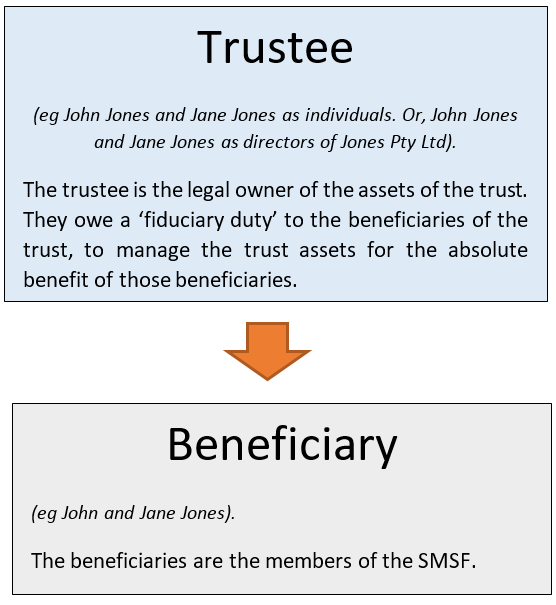

A SMSF is a special type of trust. A trust is a legal arrangement in which the legal ownership of an asset is separate to the beneficial ownership. The legal owner of an asset is responsible for managing that asset. For example, the legal owner of a bank account is responsible for any money saved within that bank account. The beneficial owner of an asset is the person for whose benefit that asset is maintained. For example, the beneficial owner of a bank account is the person for whose benefit any money held within that account is intended to be used. In such a case, money must be spent for the betterment of the beneficial owner.

Most superannuation funds, both managed and self-managed, operate via a trust. Trustees are the legal owners of the trust assets. Fund members are the beneficial owners of those assets.

There are many different kinds of trust. Many businesses, for example, operate through some form of trust, often using a company as the trustee. Private investors might make use of an investment trust. A testamentary trust is a trust that is created when a person dies and wishes to have their assets managed on behalf of their beneficiaries (for example, if their beneficiaries are still children and can’t manage assets themselves).

A self managed super fund is a special type of trust. It is special because the trust assets are held and managed by a trustee for the purpose of providing retirement income and other benefits to members. This means the trust qualifies for special income tax concessions under the tax law.

A SMSF is a super fund with less than five members that is managed by its members. SMSFs are also known as ‘DIY funds.’ The Australian Taxation Office (“the ATO”) is the main SMSF regulator, and has the responsibility of overseeing SMSFs in Australia.

The members, or a company owned and controlled by the members, act as the trustees. The trustees control the SMSF’s investments and are generally responsible for the SMSF’s administration and its compliance with the law.

A SMSF is controlled by a trust deed. The trust deed sets out the rules the SMSF has to follow. It also sets out the obligations and responsibilities of the people connected to the SMSF, ie the members and the trustees. The rules for paying contributions on retirement or death, investing assets, holding meetings, appointing trustees, paying benefits to members and the other matters affecting the SMSF are also found in the trust deed.

The three essential parts of a trust are present in a SMSF. These are:

- a trustee;

- trust property; and

- beneficiaries, in this case called “members”.

The trust deed must have special rules if the SMSF is to be a complying super fund and be eligible for tax concessions. However, it is the trustee’s year-to-year conduct that ultimately determines the SMSF’s eligibility for tax concessions.

To be a SMSF the fund must be a super fund and must also satisfy a number of conditions set out in section 17A of the SIS Act. These conditions are:

- the fund must have fewer than five members;

- if the trustees of the fund are individual persons, each of them must be a trustee;

- if the trustee of the fund is a company, each member must be a director of that company;

- the members are not in an employment relationship unless they are relatives;

- no trustee derives any personal benefit from providing services to the fund or for performing his/her/its duties as a trustee.

Chapter 2: Who’s who in an SMSF

Members

People who use an SMSF to manage their super are known as members of that fund.

A person is a member of a fund if the trustee of the fund holds benefits on trust for them. The role is analogous to a beneficiary of a family trust, or a unit holder of a unit trust. The member is entitled to receive benefits from the SMSF on the occurrence of certain specified events, such as reaching a certain age, or dying (in which case the benefits are paid to the member’s estate or dependants or a nominated person).

Most SMSFs only have two members. Often, these members are a couple, leading to the colloquial term ‘mum and dad’ funds. A minority will have members of another generation (i.e. parents and children) as members too. It generally does not make sense for unrelated people to be members of the same SMSF. More commonly, two or more unrelated people will establish separate funds so as to keep their financial arrangements separate.

The most obvious distinction of a self managed superannuation fund, is that each member of the fund must also be a trustee of that fund. There are two ways to be a trustee: in one’s own name, or as a director of a company where that company is the trustee of the fund. But in order to be a self managed superannuation fund, a member must have a managerial responsibility for the fund assets.

No more than six members

An SMSF can have no more than six members. The number of members is limited so that the SMSF cannot become too big. This rationale is not perfect, as obviously it is possible for a one member fund to hold more member benefits than a six member fund. But it does make some sense. It also means that individual SMSFs do not become too big, and that the members stay in control.

Many of the consumer protection type rules in the law do not apply to SMSFs. The rule that members must be trustees means that members will automatically have access to financial information and other information about the fund, and so a further layer of protective regulation is not necessary. This simplifies the costs of running SMSFs and makes them more accessible and workable. Increasing the number of members beyond six members would run contrary to this policy, making SMSF less workable, more expensive and more difficult to run.

Single member funds

Under trust law, it is not possible for a person to be the trustee for himself or herself. This is because the separation of beneficial ownership and legal ownership of trust property is an essential aspect of a trust. If the same person holds both beneficial and legal ownership of a piece of property, then there is no trust.

This posed a problem for the legislature when the rules for self managed superannuation funds were being drafted: how can the ‘all members must be trustees’ rule be satisfied in the case of a single member fund? Two solutions were established:

- a sole director/shareholder company can act as trustee, with the member as the sole director and shareholders (since this creates the necessary separation of beneficial ownership and legal ownership); or

- another person can be a trustee while holding no benefits in the fund – provided that other person is a relative.

A “relative” is defined widely and goes as far as second cousins, and includes relatives by marriage or adoption, de-facto spouses, and ex-spouses. “Spouse” includes a same sex partner.

Members who are also employees

A person cannot be a member of the same fund as his or her employer, unless they are related. This rule is intended to make sure that self-managed super funds do not become de-facto employer-sponsored funds, but without the extensive consumer protection type rules afforded to employees in these funds.

Auditor

An auditor is a finance professional who checks that self managed super fund is being run in accordance with all relevant rules. These rules include both the trust deed for the individual SMSF as well as the general superannuation law.

In order to comply with the law, and therefore gain access to the various tax concessions available to an SMSF, an SMSF must engage a registered auditor who is independent of the fund. The Australian Tax Office have provided the following simple video to explain the role of an SMSF auditor:

Administrator

In order for an auditor to be able to perform their role, various administrative tasks need to be completed for an SMSF. These tasks can be completed by a member, but more commonly the fund will engage some form of professional administration to do this for them in an efficient and compliant way. Engaging a professional administrator typically means that the administration is performed more effectively, and in particular that the annual audit can be completed in a more efficient and therefore less expensive way.

Chapter 3: Advantages of an SMSF

With more than 1 million Australians choosing self managed superannuation, there are clearly several advantages to this form of super. Let’s look at some of the main ones in turn.

Control

The main benefit of a SMSF over another super product is control over all aspects of the fund. Members have legal control of the assets in the fund.

A key feature of a SMSF is the ability to make direct investments. Direct Australian shares are a particularly common investment option as they often provide tax-effective dividend income to the SMSF.

Members are also able to invest in direct property, either using the available cash in their fund or through limited recourse borrowing arrangements, which we discuss below. For example, with a geared residential property that is rented out, the rental income would cover the outgoings and the interest, perhaps some help from new contributions. With a view of an investment timeframe of 20 years, the drive of this strategy is the expected capital gain. This may not then be realised until the SMSF is in pension mode (i.e. after age 60), meaning that the bulk of the return will be capital gains tax free.

Other investment options include international shares, managed funds, listed unit trusts and investment companies, artwork, and other “exotic” investments (although we must admit to taking a very conservative line when it comes to assets in which an SMSF should invest).

The control clients have over their SMSF means that they can also act quickly to change their investment strategy, if their appetite to risk changes or due to some other change in their personal circumstances.

Information

Related to this enhanced control, using an SMSF means you usually don’t have to wait for months after 30 June each year to find out how your investment is performing. The information is always readily available. Most trustees can access information on virtually a daily basis.

The rapid growth in internet trading is increasing the amount of information available on demand to SMSF trustees. Most e-traders provide free portfolio tracking software, which means clients get immediate reports on the state of their portfolios at any time. Relatively inexpensive software packages can then make it even simpler for SMSF trustees to run their own investment portfolios with minimum effort and maximum satisfaction.

Synergy with other investment and business strategies

SMSFs can create synergies with the member’s other investment and business activities. The SMSF’s investment strategy should be prepared as part of an overall investment strategy reflecting the member’s attitudes and overall financial profile. The member’s legal Will andgeneral estate planning should be considered as part of this strategy.

For example, it can make sense for an SMSF to minimise property investments if the member’s non-super assets are invested heavily in property. Overall, the investment portfolio is balanced, even if the SMSF invests solely in shares. Alternatively, a member with a large diversified personal shareholding in their own name may choose not to diversify within their self-managed superannuation fund in the hope that they can achieve above-average returns in that tax advantaged environment.

A managed fund, with thousands of members of all ages and from all walks of life and with vastly different financial profiles, will find it almost impossible to complement each of those members personal financial management as efficiently as an SMSF.

Another example is where it comes to death benefits paid after a member dies. In most cases eligible termination payments paid direct to a deceased member’s dependants are tax-free in the dependant’s hands. This applies to all super funds, not just SMSFs. But as SMSFs are usually controlled by the deceased member’s nearest relatives there is more tax planning potential and certainly more control.

Personal Satisfaction

Many, if not most, people who run SMSFs do so simply because they enjoy it. They like the control and they are genuinely interested in investing. They enjoy learning about investment opportunities.

SMSFs do not have to take up a great deal of time. Some people get by with just a few hours a year. They only buy quality blue chip shares or some other conservative investment, such as an index fund, and never sell. This strategy has worked well in recent years and has the added benefit of lower administration costs since there are fewer transactions to record and monitor. This strategy is common with younger people with smaller funds and/or larger work and family commitments.

Other people enjoy spending a few hours a week or in some cases even a few hours a day attending to their SMSF investments. They believe they can add to its performance by paying closer attention to the investments. Older people who are retired from full time work are sometimes inclined to do this. With the low cost of e-trading, and the huge amount of information available on the Internet, we are seeing a new class of investor who works his or her SMSF hard in the pursuit of extra profits.

In some cases, a member of a self-managed superannuation fund may choose to only hold investments they believe are ‘ethical.’ Trustees can structure the SMSFs’ investment strategy so that no unconscionable investments are held, or so that socially advanced investments are emphasised. Social responsibility is a big thing for many people.

Put simply, for many people spending a few hours on their investments beats playing bowls or crazy whist!

Life Insurance

Life insurance premiums paid through a SMSF can be tax deductible. In some cases this can greatly reduce the cost of the cover and therefore become the cheapest way to arrange life insurance. In some cases, the tax benefit connected to deductible premiums more than covers the cost of running the SMSF.

Any insurance benefits paid will be included in the SMSF’s assessable income. Whether there is a tax charge or not will depend on the fund’s tax profile: the worst case is a tax charge of 15%, and the best case is a tax charge of 0%, which will apply if the SMSF is paying an allocated pension at the time of the member’s death.

Managed superannuation funds can also provide life insurance benefits, but the member is bound to use whichever insurer the trustees of the managed fund choose.

As a result, people who wish to use superannuation to access life insurance often choose a self managed superannuation fund so that they can exercise discretion as the trustee and select the insurer.

Chapter 4: Using a self managed superannuation fund: contributions

Money that is transferred into superannuation on behalf of a member is known as a ‘contribution.’ There are two types of contribution: ‘concessional’ and ‘non-concessional.’ Making a contribution into a self managed superannuation fund is generally quite simple. Most SMSF’s make use of some form of bank account (which may be a cash management account or similar) and a deposit into this account is all that is required for a contribution to have taken place. The fund then needs to retain a record of what the contribution was and to whom it related.

The remainder of this section has been reproduced from our previous e-book on superannuation generally.

Concessional contributions

Concessional contributions are ‘before tax’ contributions. This means that they are made using income that is yet to be taxed. They include employer contributions (also known as ‘super guarantee contributions’ or SGC), salary sacrifice contributions and any other contributions which a member has effectively claimed a tax deduction for.

The term ‘before-tax’ means that the member does not pay tax on the contributions before they are sent to the super fund. Once contributions arrive in a fund, they are generally taxed at 15%. The fund pays this tax, and the member’s balance within the fund is reduced accordingly. Contributions on behalf of high income earners who have an adjusted taxable income in excess of $250,000 per annum are taxed at a higher rate of 30%. This limit fell from $300,000 to $250,000 on 1 July 2017.

High Income Earners – Division 293 Tax

The typical tax rate of 15% applies to contributions on behalf of people whose income is less than $250,000. Contributions on behalf of high income earners who have an adjusted taxable income in excess of $250,000 per annum are taxed at a higher rate of 30%. This limit fell from $300,000 to $250,000 on 1 July 2017.

The excess tax is sometimes known as ‘Division 293 tax.’ Division 293 is the relevant section of the Income Tax Assessment Act (Cth) of 1997.

Division 293 reduces the tax benefit available for concessional superannuation contributions for people whose ‘relevant income’ (basically, their taxable income plus contributions) exceeds $250,000. In these cases, the ‘excess’ contributions into super are taxed at 30%. The way the tax works can be illustrated using three examples.

Jodie has a taxable income of $250,000. She also received concessional contributions into her super fund of $23,750. Her total income for division 293 purposes is $273,750. Ordinarily, the concessional contributions of $23,750 would incur tax of $3,562.50. This is 15%. However, because she is above the $250,000 division 293 threshold, her concessional contributions incur tax of 30%. The tax payable within the fund becomes $7,125.

Jackie has a taxable income of $240,000. She also received concessional contributions valued at $22,800. Her total income for division 293 purposes is $262,800. This is $12,800 above the $250,000 threshold. As a result, $12,800 worth of her concessional contributions incur tax of 30%. This is $3840. The balance of her superannuation contributions is $10,000 (the total contributions of $22,800 minus the ‘excess’ $12,800). This $10,000 is only subject to the normal superannuation tax rate of 15%, which equates to $1,500. So, the total tax payable by her super fund on the contributions is $5,340.

Jackie’s example shows that the Division 293 tax only applies to that part of the total relevant income that exceeds $250,000.

Jenny has a taxable income of $230,000. She also received concessional contributions valued at $19,999. Her total income for division 293 purposes is $249,999. This is below the threshold, so she is not subject to division 293 tax. Her superannuation fund only pays the ‘normal’ 15% tax on the $19,999 of contributions. This equates to $2,999.85.

In the case of Jodie and Jackie, their non-superannuation income is taxed at the marginal rate of 47% (including Medicare levy). This is more than both the standard superannuation tax rate of 15% and the division 293 superannuation tax rate of 30%. As a result, they still both pay less tax by receiving income as concessional contributions than they would if they received that income personally. But the division 293 tax reduces the benefit of the super contributions. The contributions are still good, but they are not as good.

Because Jenny has kept her total relevant income below the threshold, she gets the most benefit from her super contributions. If Jenny kept her income low by doing some effective tax planning, then that planning has paid off in spades.

Our message is: people with taxable income around $250,000 will benefit from expert tax and financial planning. Basically, for every dollar by which they reduce their personal taxable income, they save $0.47 in personal income tax. However, because of the way division 293 tax works, if their total relevant income exceeds $250,000, then for every dollar by which they reduce their personal taxable income, they will also save an additional $0.15 in tax through their superfund.

Arguably, the overall marginal tax rate for people affected by division 293 becomes 62% (47% marginal tax rate plus 15% division 293 tax, although this rate is only applied to an amount equivalent to their concessional superannuation contributions, which are capped at $25,000).

Sometimes, division 293 tax ‘sneaks up’ on people. A person’s taxable income can exceed $250,000 without them really realising it. Sometimes, the culprit is a one-off taxable receipt, such as a capital gain or an eligible termination payment. Sometimes, income just grows without a person noticing (this can be a particular issue for self-employed people). More likely, people simply do not realise that division 293 tax applies – until they get that first tax bill.

In many ways, earning ‘too much’ is a nice problem to have. But 62% is a substantial marginal tax rate. So, if you think division 293 might be an issue for you, it is well worth getting expert advice to see what can be done. If this is you, please talk to us. If we can’t help you ourselves we will put you in touch with someone who can.

And one last thing to remember: once the tax year is over, it is usually too late to do any useful tax planning. Tax planning needs to be done before a financial year ends, not after.

Tax on concessional contributions

As stated above, most concessional contributions are taxed at 15% in the hands of the superannuation fund. The fund pays this tax directly to the Australian Tax Office (‘ATO’).

To illustrate how this all works, think of an employee earning $70,000 a year. Under the superannuation guarantee rules, her employer must make a contribution worth 11.5% of her salary into super. 11.5% of $70,000 is $8,050. The employer pays this full amount directly into the employee’s super fund.

Superannuation is treated differently to the $70,000 of salary paid to the employee. For the employee’s salary, the employer must deduct the employee’s tax payments from the gross salary and send it to the tax office. The employer only gives the employee the after-tax amount. So, for salary, the employer pays the money to 2 places: the employee and the tax office.

For superannuation contributions, the employer does not withhold tax. Instead, the employer pays the full amount of the contribution into the superannuation fund and the superannuation fund pays tax to the government. The employer only pays money to one place: the superannuation fund.

In the case of an employee on a salary of $70,000, the employer must contribute $8,050 directly to the fund. Having received the money, the fund must then pay tax of 15% ($1,207.5) directly to the tax office. This leaves $6,842.5in the employee’s superannuation account.

Concessional contributions are taxed at a flat rate of 15%. This is less than the amount of tax that the employee on $70,000 a year would have paid had she received the extra $ $8,050 as salary. On a salary of $70,000, an employee’s personal marginal tax rate is 32%. So, had an employee received $8,050 as a salary, she would have paid $2,576 in tax. So, she would only have received $5,474 after tax.

Of the $8,050, the super fund is left with $6,842.5 after tax. The employee would only have been left with $5,474 after tax had she received the money as taxable income. So, in return for the money being locked up within superannuation until later in her life, the employee retains an additional $1,368.5.

The employer claims a tax deduction for both the $70,000 of salary paid and the $8,050 of super contributions paid.

Once an Australian tax payer has taxable income above $18,200, their marginal income tax rate is at least 16% (plus Medicare Levy of 2% where applicable). This means that the tax rate applicable within superannuation is less than a person’s marginal income tax rate in most cases. This in turn means that receiving remuneration into a super fund allows most people to end up with greater wealth than they would have if they received the same remuneration as taxable income.

The lower tax rate within super is designed to do two things. Firstly, it encourages people to use superannuation – they end up with more money if they do so. Secondly, as we will discuss below, investment earnings within super are also taxed at a lower rate. This means that people start with more in super and then get to keep more of the investment earnings that their super creates.

Salary Sacrifice

The superannuation guarantee rules oblige most employers to contribute an amount equal to 11.5% of an employee’s wages or salary into superannuation. Usually, an employee can choose to direct that some more of their salary or wages be contributed into super as an extra contribution on their behalf. This is known as a ‘salary sacrifice.’

The logic of salary sacrifice is simple. If a person has taxable income greater than $20,000, their marginal income tax rate will be at least 16% (plus Medicare Levy of 2% where applicable). That means that for every dollar of salary or wages that they earn, they receive no more than $0.84. If, instead of receiving that dollar as wages or salary, the employee receives the dollar into their superannuation fund, the fund and the pays tax of 15%. This means that the employee is left with $0.85 within the superannuation fund.

Personal marginal income tax rates increase as income increases. For example, once a person’s taxable income has reached $45,000, their marginal income tax rate becomes 32% (Medicare levy included). This means they only get to keep $0.68 for each dollar that they earn above $45,000. Once taxable income goes over $135,000, the marginal tax rate increases to 39% (Medicare levy included), meaning people only get to keep $0.61 of every dollar they earn, etc. The full list of rates for the 2024-25 tax year is as follows:

Income – Marginal tax rate

| $0 – $18,200 | 0% |

| $18,201 – $45,000 | 16% |

| $45,001 – $135,000 | 30% |

| $135,001 – $190,000 | 37% |

| $190,001 and above | 45% |

(The rates above exclude Medicare Levy of 2% but note that this is not applicable to low income earners.)

As can be seen, the financial benefit of salary sacrifice increases as taxable income increases.

As discussed below, the total concessional contributions that a person can have in a given year is capped at $30,000. Therefore, the amount that can be salary sacrificed is limited to $30,000 less any amount being paid into super as a superannuation guarantee. A person who receives a superannuation guarantee contribution of $10,000, for example, can only sacrifice an additional $20,000 of income into superannuation.

Personal Contributions

Members of super funds can claim a tax deduction for contributions that they pay directly into a superannuation fund, provided they flag their intention to do so with the recipient fund. Contributions made by the member himself or herself are known as ‘personal contributions.’ Personal contributions can be made up to the age of 74. However, individuals aged 67 to 74 must meet the work test to make or receive personal super contributions unless they qualify for the work test exemption.

As discussed in the next section, a person can only make personal contributions such that their total concessional contributions do not exceed $30,000 in a given year.

The Concessional Contributions Cap

The tax advantage for concessional contributions is subject to annual limits. For the 2024-2025 financial year, concessional contributions are capped at $30,000 per year.

Contributions exceeding this cap will be taxed at the member’s marginal tax rate and included in their non-concessional cap, unless the member chooses to withdraw the excess funds. Members can elect to withdraw up to 85% of the excess to help pay their income tax assessment.

Individuals with total superannuation balances below $500,000 (at the end of the previous financial year) can take advantage of the carry-forward rule. This allows them to use unused concessional contribution cap amounts from up to the previous five financial years. Let’s look at an example below.

On 30 June 2024, Jackie had a total super balance of $200,000. She hasn’t fully utilised her concessional contributions caps in the past five financial years, making her eligible to carry forward her unused caps.

To calculate how much she can carry forward in 2024-25, Jackie adds up her total unused caps from the past five years (the difference between her contributions and the total cap for each year):

- $9,000 in 2019-20

- $14,000 in 2020-21 and 2021-22

- $0 in 2022-23

- $12,500 in 2023-24

Jackie’s total available carry-forward amount for 2024-25: $49,500

For 2024-25, the concessional contributions cap is $30,000. However, Jackie can use her unused cap amounts from the past five financial years in addition to the 2024-25 concessional contributions cap.

Jackie’s maximum concessional contribution for 2024-25: $49,500 + $30,000 = $79,500

This means she can contribute up to $79,500 as a concessional contribution for the 2024-25 financial year without exceeding the yearly cap.

| Financial year | Concessional contributions cap | Jackie’s concessional contributions | Unused concessional contributions cap available to carry forward |

|---|---|---|---|

| 2019-20 | $25,000 | $16,000 | $9,000 |

| 2020-21 | $25,000 | $11,000 | $14,000 |

| 2021-22 | $25,000 | $11,000 | $14,000 |

| 2022-23 | $27,500 | $27,500 | $0 |

| 2023-24 | $27,500 | $15,000 | $12,500 |

| Total unused concessional contributions: | $49,500 | ||

| 2024-25 Concessional Contribution Cap | $30,000 | ||

| Maximum concessional contribution for 2024-25: | $79,500 |

Contribution splitting

Contribution splitting is a strategy that allows a superannuation member to transfer certain contributions from their account to their spouse’s super account. This provision was initially introduced to address the superannuation imbalance often experienced by spouses (typically women) who have interrupted work patterns due to family responsibilities, resulting in lower retirement savings.

Under current rules, a member can split up to 85% of their eligible concessional contributions from the previous financial year to their spouse’s account. Eligible contributions include employer contributions, salary sacrifice, and personal contributions claimed as a tax deduction. It’s important to note that splitting doesn’t reduce the amount counted towards the contributor’s concessional contributions cap.

The transferred funds are treated as a ‘rollover’ rather than a new contribution, meaning they aren’t taxed again in the recipient’s account. As these funds originate from concessional contributions, they form part of the taxable component in the recipient spouse’s fund.

To be eligible to receive split contributions, the receiving spouse must be either:

- Under preservation age, or

- Between preservation age and 65 and not retired

While contribution splitting was originally designed to benefit non or low-earning spouses, it’s often used for various strategic purposes:

- Transferring contributions from a younger partner to an older spouse, potentially allowing earlier access to the funds.

- Balancing super accounts between spouses to optimize Centrelink entitlements, sometimes by deliberately minimizing one spouse’s balance.

- Managing the transfer balance cap by spreading superannuation savings across both partners.

It’s worth noting that contribution splitting applications typically need to be made in the financial year following the one in which the contributions were made, with some exceptions. Additionally, some super funds may charge a fee for this service, so it’s advisable to check with your fund.

Non-concessional contributions

Non-concessional contributions are ‘after-tax’ contributions that a member can make to their superannuation fund. These contributions are not taxed when entering the super fund and form part of the ‘tax-free component’ within the fund. Members do not receive a tax deduction for these contributions.

The rationale behind non-concessional contributions is that the money used has either already been taxed or would not be subject to tax outside of super, making it unfair to impose additional tax within the super fund.

For example, a person receiving an inheritance lump sum, which is already ‘after-tax’, might choose to invest it in their superannuation fund as a non-concessional contribution. Once in the fund, earnings are taxed at a maximum of 15% (reduced to 10% for capital gains on assets held longer than 12 months).

Non-concessional contributions are encouraged as a matter of social policy, as increased personal wealth in super may reduce reliance on government pensions in retirement.

As of the 2024-2025 financial year, the annual non-concessional contributions cap is $120,000. Individuals under 75 can use the ‘bring-forward’ rule, allowing them to contribute up to three years’ worth of non-concessional contributions ($360,000) in a single year, subject to their total superannuation balance.

Non-concessional contributions can be made up to age 75. The work test has been abolished for most contribution types for individuals up to age 75. However, individuals must still meet the work test to make personal deductible contributions between ages 67-74.

Importantly, non-concessional contributions cannot be made if an individual’s total superannuation balance equals or exceeds the general transfer balance cap, which is $1.9 million for the 2024-2025 financial year.

Contributions exceeding the cap are subject to additional tax. The member has the option to withdraw the excess contributions, plus 85% of the associated earnings. If this option is chosen, no additional tax is payable on the withdrawn excess contribution, but the associated earnings are included in the member’s assessable income and taxed at their marginal tax rate, with a 15% tax offset. If the excess contributions are not withdrawn, they will be taxed at the highest marginal tax rate (currently 47%, including Medicare levy). It’s important to note that the choice to withdraw must be made within 60 days of receiving the excess non-concessional contributions determination from the ATO. If no choice is made, the excess contributions will remain in the fund and be taxed accordingly.

The downsizer contribution scheme allows individuals aged 55 and over to make a one-off contribution of up to $300,000 per person ($600,000 per couple) from the proceeds of selling their main residence. This contribution doesn’t count towards the non-concessional contributions cap and is exempt from the work test and total superannuation balance limit. Note that the contribution must be made within 90 days of receiving the proceeds from the sale of the home. It’s also worth mentioning that the home must have been owned for at least 10 years before the sale.

This measure aims to encourage downsizing, potentially improving housing supply. It effectively allows older Australians to convert part of their tax-free home investment into a tax-advantaged superannuation investment.

Given the complexity of these rules and their potential impact on retirement planning, it’s advisable to seek professional financial advice before making significant non-concessional contributions or considering the downsizer scheme.

Chapter 5: Investment in an SMSF

One of the main advantages of a self managed superannuation fund is that the trustees are in control of the investments made by that fund.

The rules governing self managed superannuation stipulate that a fund must have an investment strategy. You can learn more about these rules by watching this short video from the Australian tax office:

The Member’s Investment Profile

When developing an investment strategy, the first thing to consider is the members’ investment profile. Put simply, an investment profile is a way of establishing the level of risk that a member is prepared to undertake in the pursuit of investment returns. As a general proposition, higher returns are related with an increased risk of a ‘negative return’ – which is a fancy way of saying ‘losing money.’

Investment profiles lie on a spectrum. At one end of the spectrum is what is known as a ‘conservative’ investment profile. As this name suggests, a conservative strategy aims to minimise the risk of losing money. Conservative investors tend to prefer investments such as cash and cash equivalents over riskier assets such as property or equities. At the other end of the spectrum is what is known as a ‘high growth’ investment profile. Under a high growth investment strategy, investments such as equities or property, with their potential for greater returns, are typically preferred.

Put very generally, the preferred investment profile is most influenced by how soon an investor is going to need the money under investment. If money is needed in the short-term, a conservative investment profile is typically applied. If money is not needed until the very long term, then a high growth strategy generally makes more sense.

It is worth remembering that superannuation assets are different to other forms of assets that the person may have. The main difference is that assets held within superannuation are preserved until the member reaches preservation age. In addition, assets held within superannuation are intended to finance a retirement, which may last 20 years or more.

As a result, people frequently underestimate how long-term – and therefore how growth oriented – the investment strategy for their superannuation benefits should be. Generally speaking, people can tend to convert their superannuation investments to a conservative profile too soon.

For example, consider a newly married couple, both aged 30, who are saving to purchase a family home. The couple have $50,000 in personal savings and $20,000 in superannuation benefits. The $50,000 of personal savings will be used as a deposit for a home. Therefore, this money should only be invested in very conservative investments such as a bank account, where the risk of losing money in the short-term is low.

But superannuation is different. This couple cannot access their superannuation for at least 25 years. Therefore, a conservative strategy makes no sense for the money held in superannuation. That money would more typically be invested in some form of high growth option.

In this way, the same person can have two or more investment profiles for different elements of their financial management.

Complementarity

One of the chief advantages of a self managed superannuation fund is that the investment strategy for the self managed super fund can tie in very closely to the members’ non-super investment strategies. This cannot always be the case with managed superannuation, where the member typically has very little control over the investment assets of the fund.

For example, consider a couple who are running their own business. They decide to use their superannuation fund to purchase premises which they will then lease to their business. In so doing, they reduce the risk to their business of being asked to vacate their business premises should an external landlord decide not to renew a contract. They create a situation where the landlord and the tenant have a common interest. When people own a business, that business is typically the centrepiece of their investment strategy. The ability to establish a self managed superannuation fund which then invests in a way that compliments that business can add to the effectiveness of the overall investment strategy.

Keep it simple

Many successful trustees of self-managed superannuation funds choose to keep the investment strategy of their fund very simple. For example, a very simple SMSF might make use of just two investments: a cash management account into which contributions are made; and a single managed fund that in turn invest into equities (for example, an exchange traded fund tracking a market index). The cash management account is a conservative investment option. The index tracking managed fund is a growth focused investment option (because it is investing in shares).

Continuing with this example, the proportion of overall fund assets held in each of these two investment options would then vary according to the investment profile of the members of the fund. For example, if the fund has two members, and they are both aged in their 70s, the fund may choose to hold 60% of its total benefits in the cash management account and only 40% in the growth oriented ETF. Conversely, if a fund has two members aged in their 30s, the fund may choose to hold a bare minimum of its total benefits in cash management account, with almost everything invested in the growth oriented ETF.

The same two investments can be used to manage the risk profile of the fund, simply by changing the allocations within the fund.

As a general proposition, administration of an SMSF is simplest where the investments made by the fund are simple. Administration becomes more complex the more investments that the fund makes. This means that a simple investment strategy can have a flow on effect of minimising administration and auditing expenses of the fund.

Direct Property

Direct property can be either commercial or residential. For clients who wish to invest their superannuation benefits in direct property, a self managed superannuation fund is basically the only way to do so. It is unusual for a managed superannuation fund to invest in direct property.

Clients wishing to make an investment into direct property do need to take care. Certain types of property, such as residential property, cannot be used by any person related to a member of a self-managed super fund that owns the property. The rules for commercial property are less stringent, but nevertheless they do still apply.

We recommend getting professional advice prior to the purchase of any form of property within a self-managed superannuation fund.

Borrowing

Under certain conditions, it is possible for a self-managed superannuation fund to borrow to purchase investment assets. This ability is discussed in the next chapter.

Chapter 6: Limited recourse borrowing

A limited recourse borrowing arrangement allows the trustee of the SMSF to take out a loan from a third party lender to purchase a single acquirable asset (or a collection of identical assets) to be held in a special purpose trust. The limited recourse aspect of the loan means that the lender’s rights are limited to the asset held in the special purpose trust. The lender will have no recourse against any of the other assets held within the SMSF.

Background

The law regarding SMSF borrowings changed on 7 July 2010. Arrangements entered into before this date are controlled by the former sub-section 67(4A) of the Superannuation Industry (Supervision) Act 1993, and arrangements entered into after this date are controlled by the new sections 67A and 67B of this Act. Borrowings may be refinanced, and a refinancing may, depending on its detail, create a new borrowing that brings the arrangement within the new rules. Instalment trust arrangements are now known as “limited recourse borrowing arrangements”.

SMSFs have always had a limited ability to borrow. However, the power to borrow was so limited that few people did it. That changed in July 2010, when the Superannuation Industry (Supervision) Amendment Bill 2010 became law.

The old rules (ie section 67(4A)) apply to borrowings entered into before 7 July 2010. The new rules (ie section 67A and 67B) apply to borrowings entered into after 7 July 2010, to restrict the form of the borrowings as follows:

- single acquirable asset – only one asset, or set of identical assets (example a parcel of shares in a listed company, listed trust, or other assets that have economically identical qualities) is permitted in each trust arrangement. This asset must be dealt with as a single asset (for example, a parcel of shares cannot be sold gradually over time. It must all be bought and/or sold at once). This rule is very restrictive for shares and similar securities but has no real effect for real estate.

- capital improvements – borrowings cannot improve the asset, but can be used to maintain or repair the asset to maintain its functional value. This is particularly relevant to real estate. For example, an SMSF cannot borrow to buy an old run down building and then borrow again to knock it down and build a new one. But a SMSF can borrow to repair or maintain a property to retain its functional value;

- lender’s recourse – this must be limited to the particular asset. This means that a lender can only take security over the assets being financed.

Borrowing to buy shares

The new rules are particularly restrictive for shares. They do not allow a parcel of shares in different companies to be held under the one instalment arrangement, and do not allow a progressive sell down of shares. For this reason, it is quite rare for self managed superannuation fund to borrow to buy shares.

Residential property

Borrowing to purchase residential property is much more common. Consider a common example: a forty-five year old couple have, say, $200,000 in super. They are concerned about their long term retirement prospects and, although they are in the 37% tax bracket and have statistically high incomes, they are cash poor because of the high costs of feeding, housing, educating and “holidaying” their family.

The couple decides to establish a SMSF, transfer the existing $200,000 of benefits in, pay future contributions in, and then borrow say $400,000 to complete the purchase of a $600,000 property. The property is then rented out, with the rent covering the outgoings and the interest, with a bit of help from their contributions.

The expected capital gains drive this investment, and the key is to not realise the capital gains until the SMSF converts to pension mode, once the couple have each turned 60. Doing this means that the bulk of the return is capital gains tax free.

Business premises

Gearing an SMSF can also be a tax effective way to own business premises. The premises are bought using a geared SMSF arrangement and then leased back on an arm’s length basis to the business.

However, here the loss of the active asset exemption for business premises held by a SMSF has to be considered, which makes the arrangement less attractive from a tax point of view than may have been first thought: SMSFs are not eligible for this exemption.

Getting advice

Borrowing within an SMSF is one area where you should really not go it alone. Professional advice is imperative, as the consequences of making an administrative error can be substantial. Indeed, if not done properly, any advantage of a geared investment may be completely lost.

Chapter 7: Getting money out of superannuation

There are two main ways in which a person can withdraw money from superannuation. The first is as a lump sum and the second is in the form of an income stream (typically known as a pension). We introduced each of these forms in our previous e-book. These introductions are reproduced below.

When deciding how best to withdraw money, you need to consider how you will use the withdrawn money. If the money is going to be saved outside of superannuation, with smaller amounts used to finance lifestyle on a month by month basis, then it generally makes sense to leave the bulk of the money within superannuation and to withdraw what is needed as a pension over time.

Conversely, if the money is going to be immediately spent, then a lump sum a make more sense.

Income streams or pensions

When using an income stream, you keep the majority of your benefits within superannuation and withdraw a relatively small amount each year. The yearly withdrawal can happen all at once, or in smaller amounts during the year (for example, monthly).

The government encourages people to use this method as this method preserves more superannuation benefits for future use, which reduces reliance on social security payments later in life. The main encouragement for people using an income stream is that no tax is paid on investment returns for assets being used to finance a pension. This includes both income returns (such as interest or dividends) and capital gains.

This means that the superannuation fund becomes a tax-free investment vehicle once a retirement phase income stream has commenced. Zero tax is hard to beat!

As of the 2024-2025 financial year, there are some important rules regarding income stream arrangements:

- The zero-tax arrangement is restricted to income streams paid after full retirement or after the member turns 60. Assets used to finance a ‘transition to retirement’ income stream are taxed at 15% on earnings and 10% on capital gains for assets held for more than 12 months.

- The tax-free treatment for earnings generated on assets used to finance an income stream is limited to an amount of assets worth no more than $1.9 million (the transfer balance cap for 2024-2025). For most people, this upper limit exceeds their total superannuation, so it doesn’t have an impact. For those with more than $1.9 million in superannuation benefits, earnings on assets above this cap remain taxable at the standard superannuation tax rates of 15% for income and 10% for capital gains on assets held for more than 12 months.

The tax-free status for superannuation funds paying a retirement phase income stream generally means that anybody who has retired and has met a condition of release should consider commencing payment of a pension. Under the rules of a pension, the money actually has to be withdrawn from superannuation, but in many cases, it’s possible for a member to re-contribute excess money back into their superannuation fund as a non-concessional contribution. People can make use of such a ‘re-contribution strategy’ up to age 75, subject to meeting certain conditions.

Transition to retirement income streams

A transition to retirement income stream allows a person aged 55 or over to start drawing income from their superannuation benefits while still working. The idea behind this type of pension is to discourage people from leaving the workforce altogether. As an incentive to stay in work, when transition to retirement pensions were first introduced, it was decided that earnings on assets used to finance the pension would not be taxed. This included capital gains, such that superannuation fund for people using a transition to retirement pension basically became a tax-free enterprise.

Key features of a TRIS as of the 2024-2025 financial year include:

- Eligibility: Available to those who have reached preservation age but are under 65 and still working.

- Withdrawal limits: Annual withdrawals must be between 4% and 10% of the account balance.

- Taxation of earnings: Unlike retirement phase income streams, earnings and capital gains on assets supporting a TRIS are not tax-free. They are taxed at 15% for income and 10% for capital gains on assets held for more than 12 months.

- Taxation of payments: For individuals under 60, TRIS payments are taxed at marginal rates with a 15% tax offset. For those 60 and over, TRIS payments are tax-free.

- Transfer to retirement phase: A TRIS automatically converts to a retirement phase income stream when the member turns 65 or notifies their fund that they’ve met a full condition of release (such as retirement).

While the tax treatment of TRIS is less favorable than when first introduced, it can still be beneficial in certain circumstances:

- For those needing to supplement reduced income from part-time work

- As part of a salary sacrifice strategy to boost super while maintaining current income levels

- For individuals aged 60-64 who can receive tax-free payments while still working

However, the suitability of a TRIS depends on individual circumstances. Those who don’t need additional income to support their lifestyle may find limited benefit in commencing a TRIS.

Lump sums

Lump-sum withdrawals from superannuation are often used to finance some form of one-off payment. This can include things like paying out home loans, purchasing a new home, paying for holidays, buying a new car, helping adult children out financially, et cetera.

If a person elects to withdraw a lump sum from their superannuation fund, they do not have to withdraw their entire balance. Whether a person should withdraw more than they need to finance a particular purchase will depend on how they will invest or otherwise use that money in excess of their needs.

Generally, it makes sense to leave as much wealth within low taxed environment of superannuation. However, individual tax circumstances can vary, and so it is always worth taking advice when considering how to treat money held within superannuation for which there is no immediate need.

Self managed superannuation funds and withdrawing money

As outlined above, once a member commences a pension from their superannuation fund, assets used to finance that pension are no longer taxed. This includes capital gains, even if the asset was purchased prior to the commencement of the pension. This can create a powerful investment strategy for self-managed superannuation funds.

Put simply, an SMSF can invest in growth assets that predominantly target capital gains, with a view to holding that asset until after all members of the fund commenced pensions. In so doing, the fund negates any capital gains tax being paid on that asset.

Consider the example of a husband and wife who are running a business together. They establish a self-managed superannuation fund and the fund borrows money the purchase their business premises. The business then leases those premises from the fund, paying a market rent to do so.

At the age of 55, the couple decide to sell the business. However, they do not sell the business premises, instead entering into a new 10 year lease with the new owners of the business. At the age of 65, both members of the couple have established a pension and at this point they sell the business premises for a substantial capital gain, on which they do not need to pay tax.

This is an example of how the investment strategy of a self-managed superannuation fund was both consistent with, but also diversified from, the investment strategy of the members in their own right.

Chapter 8: Regulation of an SMSF

The Australian Taxation Office (“ATO”) is responsible for enforcing the SIS Act and other super laws as they apply to SMSFs.

If the SMSF’s deed is drafted properly and the trustees comply with the law, the SMSF will be eligible for tax concessions. These concessions can include a deduction for concessional contributions and concessional tax on the SMSF’s income. These tax concessions drive the SMSF’s enhanced investment performance. It is the tax concessions that make super such an attractive investment medium and allows it to outperform alternative investments.

Although theoretically onerous, trustees are normally able to satisfy these rules without any difficulty. The ATO is helpful, not obstructive and it is on the record as saying it will follow the standards set by its predecessor, the Australian Prudential Regulation Authority (‘APRA’). It is important not to overstate the risk of breaching the law. In most cases SMSFs run smoothly and difficulties are not encountered. Except for cases of extreme culpability, a SMSF that has inadvertently breached the super law will generally be deemed to have complied with the law by the Regulator. Where there is a minor breach of these rules, the Regulator generally uses its discretion to deem the SMSF to have complied with the rules.

What happens if a SMSF breaches the law?

A SMSF must be a complying super fund to get the benefit of the tax concessions extended to super funds. If a SMSF seriously breaches the super law it may become a non-complying fund and may lose the benefit of these tax concessions. It may also become liable for certain penalties, as may its advisers, particularly its auditors.

It is virtually unheard of for a SMSF to deliberately become non-complying. It just does not happen except in the most extreme cases, and this is a place few people choose to go to and one we definitely recommend you stay away from. Examples might include things like buying holiday homes in a SMSF – and then using them.

More common errors tend to be inadvertent. For example, a payment is misdirected or some other form of clerical error is made. The ATO is, sensibly, mostly forgiving when inadvertent errors are made leading to non-compliance. It rarely plays a hard hand provided the error is corrected and does not reoccur. The best option for a trustee where an error has been made is to fully disclose the error to the ATO (see below for further comment here).

SMSF compliance

The ATO does not issue annual notices that SMSFs are complying funds. Rather it issues an initial notice when the SMSF is first formed. Thereafter it only issues a notice if requested to do so by the SMSF, provided the ATO has not issued a notice under section 40 that the SMSF is no longer a complying fund and it is a non-complying fund. Therefore, once a SMSF is formed and has obtained an initial notice that it is a complying fund it continues to be a complying fund unless it receives a notice from the ATO saying it is a non-complying fund.

This means SMSF compliance is a ‘self-assessment’ system. The SMSF’s auditor plays a critical role. The auditor must certify that the SMSF has complied with the super law and this certificate is included in the annual return lodged by the SMSF with the ATO. If this certificate is not provided the ATO will issue a notice under section 40 that the SMSF is not a complying super fund.

The audit can be broken into two parts. The first part is a financial audit and this relates to the correctness of the financial statements and related documents. The second part is a compliance audit and this relates to the SMSF’s compliance with the SIS Act, and particularly whether the fund has not breached the various laws applying to SMSFs, for example, has not acquired an inappropriate investment, has not paid out member benefits in circumstances that breach the SIS Act.

Must the auditor report breaches of the super law?

This is dealt with in section 129 of the SIS Act.

If an auditor believes that the SIS Act has been breached the auditor must inform the trustee in writing of the breach. The auditor does not have to do this if the auditor honestly believes the trustee is already aware of the breach, but a wise auditor will do so anyway.

The auditor must then report the breach to the Regulator if:

- the trustee does not comply with the auditor’s request for a report regarding the proposed or actual action to be taken in respect of the breach; or

- the auditor is not satisfied with that action.

What happens if a SMSF does breach the super law?

From time to time SMSFs will breach the super law. Usually these breaches are not deliberate and in effect excused by the ATO, provided they are disclosed and are rectified as soon as possible. We have not seen the ATO not use its discretion favourably.

In practice, it is important for the SMSF to be able to show that the breach was inadvertent, not deliberate, and was rectified as soon as practicable once the SMSF became aware of the breach. For example, way back in the year ended 30 June 2000 a client SMSF with more than $1,000,000 lent the members’ daughter $20,000 on commercial terms to help buy a car. The SMSF believed this investment was valid, because the loan was less than 5% of the SMSF’s assets and therefore did not breach the sole purpose test. The SMSF did not realise that the investment would breach the rule against loans and other financial assistance to members. Immediately on being informed of the breach the SMSF arranged for the loan to be repaid. The auditors did not certify that the SMSF had complied with the law and specifically brought the breach to the ATO’s attention.

The ATO exercised its discretion in favour of the SMSF. It was satisfied that the breach was not deliberate and that the SMSF had done all it could to rectify the breach once it was discovered.

We expect that the situation would be different if the ATO had discovered the breach or if rectification had not been made.

Consequences of a SMSF becoming non-complying

The ATO have released a short video explaining the process they apply when a breach occurs.

If a SMSF ceases to be a complying fund it loses the tax concessions extended to complying funds and become liable to a tax charge equal to the highest marginal tax rate of the value of its assets, less un-deducted contributions. If a SMSF with $1,000,000 of assets becomes a non-complying fund it will face a tax charge of $450,000 (45%).

The logic behind the tax charge being the value of the SMSF’s assets less un-deducted contributions is that this effectively reverses the tax concessions previously applied to the contributions received by the SMSF. In most cases it will go further than this, since the contributions are taxed at 15% and are possibly subject to the 15% super surcharge. There is no adjustment for this, plus the underlying assets have probably increased in value, and this increase is subject to tax at 45% even though it may not have been realized. This makes the penalties very onerous indeed.

This is a serious penalty, and although it is rare, it explains our conservative stance on so many issues: it’s just not worth taking risks with SMSFs and their complying fund status. When it comes to SMSFs, choose any flavour as long as it is vanilla.

Common problem areas

A SMSF may breach the super law in any number of ways. In a paper on SMSFs delivered to the Taxation Institute of Australia, Chris Kestidis of Hall and Wilcox, Lawyers, identified the following problem areas:

- special income, a situation where the SMSF derives income from related parties, such as a company or a unit trust, on a non-arm’s length basis;

- in-house asset rules, particularly those for investments in geared unit trusts; and

- sole purpose test, particularly where assets have a second purpose of being available for use by members and family and friends.

Chapter 9: Starting and Ending an SMSF

Setting up a SMSF

Who can set up a SMSF?

There is no restriction on who can establish SMSFs. They are set up by people of all ages and from all walks of life. Normally people with higher incomes or who have significant wealth set up SMSFs. Older people predominate, since they are typically able to pay larger contributions, have larger amounts to rollover into an SMSF – and they are more aware of their ultimate retirement. Younger people using SMSFs to set themselves up for later life are becoming increasingly common.

How much do you need to set up a SMSF?

There is no legal minimum amount required to set up an SMSF. However, a common sense approach is required. When a client has a substantial initial balance, say $200,000, the SMSF starts to become a more attractive and cost effective option, mainly due to the fact that the administration fee for an SMSF tends to be stable regardless of the number of assets. Administrative fees are typically a function of the complexity and range of investments within the fund, rather than their absolute size. For example, there is no additional cost in administrating $100,000 worth of shares in a particular company compared to administrating $10,000 worth of shares in the same company.

That is not to say that an SMSF cannot be appropriate for a person with less than $200,000 to invest. There can be good reasons for setting up an SMSF with fewer assets , such as:

- The client’s desire for control over their investments;

- Intention to have larger future contributions;

- Intention to have a simple low cost investment strategy;

- High level of awareness and experience of investments markets and investment risk; and

- High level of awareness and sophistication regarding potential

Ending an SMSF

SMSFs are not forever. There are various reasons that an SMSF needs to come to an end, and then there are various ways that the end can be managed.

The ATO have released a short, easy-to-understand video on winding up an SMSF:

Reasons to finish up an SMSF

In an article for the excellent online publication, Firstlinks, commentator Julie Steed nominated the ‘seven D’s’ that may cause an SMSF to be finished up with. They are:

- Death;

- Disability;

- Dementia;

- Disinterest;

- Divorce;

- Departure; and

- Disqualification.

In some ways these are self-explanatory, but some deserve a little more comment.

Death

The death of a member typically requires the payment of a death benefit to an eligible death benefit beneficiary. Depending on the balance of the member who died, this might reduce the benefits that remain within the SMSF below the point at which the SMSF remains efficient.

Unless an SMSF has a corporate trustee (that is, a company is the trustee for the fund), then it must have at least two members. In cases where there is not a corporate trustee and a member dies, there needs to be at least two surviving trustees to continue managing the fund. A new member may join the fund following the death of the previous member, keeping the number of members above one. Alternatively, the sole surviving member may establish a company and transfer legal ownership of the SMSF’s assets to this new corporate trustee. However, if there is no such person available, then the sole surviving member will need to wind up the SMSF and transfer their benefits to an alternative type of fund.

The ATO have created a simple video explaining what happens when a member of an SMSF dies:

Disability and Dementia

A member of a fund who becomes disabled might trigger the need for the fund to pay a disability benefit to the member. Once again, this might reduce the benefits that remain within the SMSF below the point at which the SMSF remains efficient.

Alternatively, the disability or dementia may mean that the member no longer has the mental capacity to manage their own super.

Trustees of a SMSF own the assets of the fund and must therefore be competent to manage those assets.

The following video discusses some of the duties that trustees must be able to perform.

Disinterest

If trustees lose interest in managing their own super, then they will need to wind up the fund and transfer their benefits to a fund manager who can manage the fund on their behalf.

Divorce

Sometimes, SMSFs are known by their colloquial name: ‘mum and dad’ funds. As this name suggests, many SMSFs are operated jointly by a couple, often with one or the other partner taking more managerial interest in the fund.

While there is no requirement that a SMSF must be wound up in the event of a divorce between two of its members, it would be a rare situation where a SMSF could continue to be operated dutifully by a couple who have separated. Trustees of a SMSF owe a fiduciary duty to the members of the fund. This means that they must put the interests of the members before even their own. In the case of a divorce, this is usually a very difficult standard to reach and maintain, and so it is much more usual that a divorcing couple would also wind up the self-managed super fund.

There is nothing to stop each partner then commencing their own SMSF, although they would need to use a company as the trustee unless they could each find at least one other co-trustee. It is also possible for one person to leave an SMSF, rolling their benefits over to another fund, while the other trustees remain. This does entail quite a lot of administration on the part of the SMSF, however, as the departing trustee’s status as the legal owner of all of the fund’s assets would need to be altered.

A separation of trustees can lead to complex tax calculations and is otherwise a difficult area. We encourage you to seek specialist legal assistance if you are in this situation.

Departure

A SMSF must be a ‘resident regulated superannuation fund’ at all times if it is to maintain it’s status as a compliant super fund. There is a three-step test for residence.

- Step 1: was the fund established in Australia or does the fund have assets in Australia? The fund’s establishment is a historical fact, and so this step is met if the fund was initially established in Australia, even if this was many years ago. If it was not, then there must be at least one asset in Australia each year.

- Step 2: was the central management and control of the fund ordinarily in Australia? The concept of ‘ordinarily’ is critical here. The concept is actually subjective and depends on the intent of any person leaving Australia. A person who leaves Australia with no fixed idea about when they will return is unlikely to meet this test. A person who is out of Australia for an extended period, but who continues to regard themselves as a resident and whose intention is for the absence to be temporary, may be able to argue that their fund is ordinarily managed from Australia.

- Step 3: does at least 50% of the balance of the active members of the fund relate to active resident members? Active members are those on whose behalf the fund is receiving contributions. If the fund does not have active members, this step does not apply. If it has both active and inactive members, then it is only the balances of the active members that are included in the calculation.

If one or more trustees depart Australia and the effect is that one or more of these tests cannot be met, the fund will be unable to retain its status as a complying fund and will need to be wound up. Losing this status can have substantial tax implications, so retaining status as residential is critical.

Disqualification

A disqualified person must not continue as a trustee of a super fund. One of the more common ‘disqualifiers’ for a SMSF trustee is bankruptcy. If a member who is a trustee in their own name becomes bankrupt, they are given six months to arrange things such that they are no longer a trustee. If a member is a trustee via being a director of a trustee company, then they must also discontinue as a bankrupt person cannot be a company director.

Remember, in an SMSF all members must be trustees, so that means that the member’s benefits must be removed from the SMSF in either of the above events. This may require the SMSF be wound up.

Effectively, this means that bankruptcy will typically necessitate the winding up of a SMSF.

Options for winding up the SMSF

There are three options available when a fund is wound up. These are:

- Pay out the benefits; or

- Convert the fund to a small APRA fund; or

- Roll the benefits over to some other form of fund.

In order for the fund to pay out the benefits, the members must all have met a condition of release allowing such payment to be made. The SMSF needs to retain sufficient assets to pay the expenses of winding down.

If one or more members are not in pension mode, then the sale of assets to facilitate paying out the benefits may trigger a tax event. This will depend on whether the asset has realized a capital gain. Such gains are taxed at 15% if realized within 12 months of the asset’s acquisition, or 10% if the asset has been held for longer than 12 months.

Converting the fund to a small APRA fund may allow for this disincentive (that is, a CGT event) to be avoided. The fund effectively continues, but with a change of legal owner. As there is no change in beneficial ownership, this change does not give rise to a tax event. This option can be a useful one if the SMSF cannot be continued, but there is one or more assets that the members would like to retain. A larger managed fund (such as a retail or industry fund) will be unable to accept such an asset as either a rollover or a contribution.

Further Information

Once again, the ATO have developed a short video explaining the need for an SMSF to plan for things that might cause an SMSF to need to finish up: